Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 23 September 2019 01:22 - - {{hitsCtrl.values.hits}}

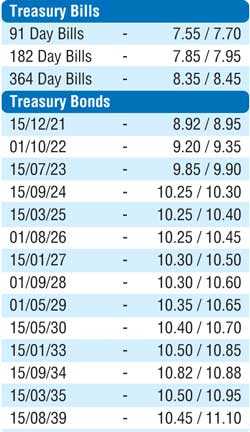

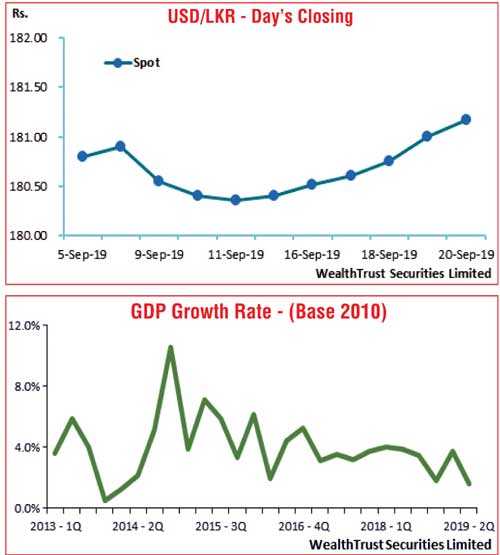

The secondary bond market came to life during the week ending 20 September with yields continuing its increasing trend during the early part of the week and decreasing once again towards the latter part of the week. The upward trend was supported by the increase in the weighted average of the benchmark 364 day bill by 5 basis points to 8.41% at the weekly bill auction while the downward run was supported by the increase in overnight liquidity, announcement of second quarter GDP at a quarterly five year low of 1.6% and a further 0.25% cut in FED policy rates.

The yields of the liquid maturities of 15.07.23, two 2024’s (i.e. 15.06.24 and 15.09.24) and 15.09.34 were seen increasing to weekly highs of 10.00%, 10.30%, 10.40% and 11.00% respectively against its previous weeks closing levels of 9.90/10, 10.30/40, 10.35/38 and 10.90/00. However, renewed buying interest at these levels resulted in yields decreasing once again towards the later part of the week to hit lows of 9.85%, 10.20%, 10.25% and 10.81% respectively on the said maturities and close the week marginally lower against its previous week’s closings. The foreign component in Rupee bonds was seen declining for a fifth consecutive week to record an outflow of Rs. 0.55 billion for the week ending 20 September.

The daily secondary market Treasury bond/bills transacted volume for the first four days of the week averaged Rs. 8.65 billion.

In money markets, the Open Market Operations (OMO) Department of Central Bank injected liquidity during the early part of the week on an overnight basis and term basis (i.e. 07 and 14 Days) at weighted average yields ranging from 7.40% to 7.46% while it drained out liquidity during the latter part of the week on an overnight basis at weighted averages ranging from 7.31% to 7.35%. The overnight net liquidity surplus increased from Rs. 6.44 billion to Rs. 59.93 billion during the week while the overall net deficit in the system improved to Rs. 39.23 billion against its previous week’s deficit of Rs. 75.59 billion as well. The overnight call money and repo rates averaged 7.44% and 7.53% respectively for the week.

Rupee dips during the week

In the Forex market, the USD/LKR rate on the spot contracts closed the week lower at Rs. 181.10/25 against its previous weeks closing of Rs. 180.35/45 on the back of a globally strengthening dollar and buying interest by banks.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 63.20 million.

Some of the forward dollar rates that prevailed in the market were one month – 181.65/90; three months – 182.70/00 and six months – 184.40/70.