Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 1 January 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

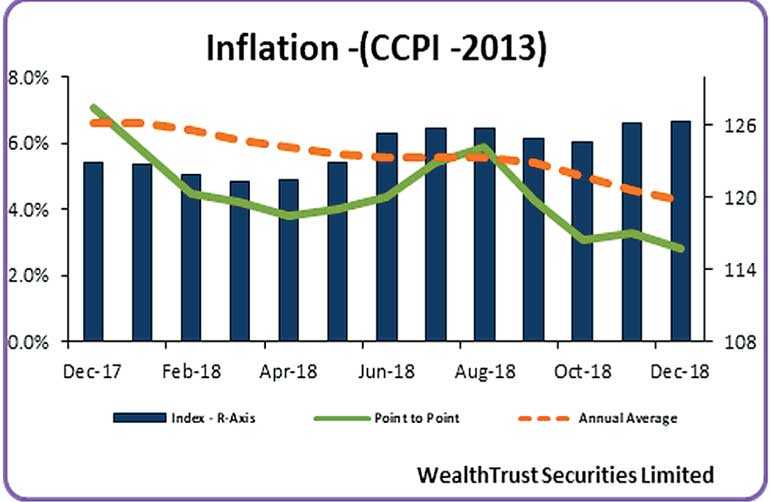

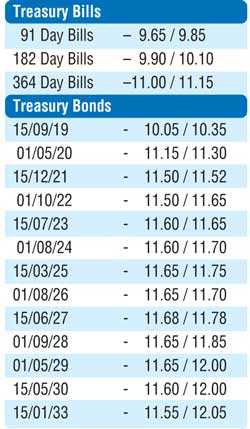

The secondary market bond yields closed the day broadly unchanged yesterday, despite the point to point inflation for the month of December reducing once again to 2.8% against the previous month’s level of 3.3% and the annualised average dropping further for a fourth consecutive month to 4.3%. A limited amount of activity was witnessed consisting of the 15.12.21 and 15.07.23 maturities at levels of 11.50% to 11.55% and 11.65% respectively.

The total secondary market Treasury bond/bills Transacted volume for the 29 December was Rs. 8.74 billion.

In the money market, overnight call money and repo rates averaged 8.95% and 9.00% respectively, as the OMO Department of the Central Bank infused liquidity by way of an overnight and a seven-day term reverse repo auction for successful amounts of Rs. 60.75 billion and 15 billion, at weighted average yields of 8.98% and 9.00%. In addition, a further amount of Rs. 91.18 billion was injected at the Standing Lending Facility Rate (SLFR) of 9.00%. The net liquidity shortfall increased to Rs. 148.37 billion yesterday.

Rupee trades within a narrow range

In Forex markets, the USD/LKR rate on spot contracts were seen trading within a narrow range of Rs. 182.95 to Rs. 183.00 before closing at Rs. 182.90/00 against its previous day’s closing levels of Rs. 182.85/20.

The total USD/LKR traded volume for the 28 December was $ 102.66 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 183 80/20; 3 Months - 185.70/10 and 6 Months - 188.70/20.

Table 2

The closing, secondary market yields of the most frequently traded T – bills and bonds,