Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 26 July 2021 02:11 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The trading activity in the secondary bond market dried up during the holiday shortened trading week ending 22 July while yields increased on the back of moderate trades.

The trading activity in the secondary bond market dried up during the holiday shortened trading week ending 22 July while yields increased on the back of moderate trades.

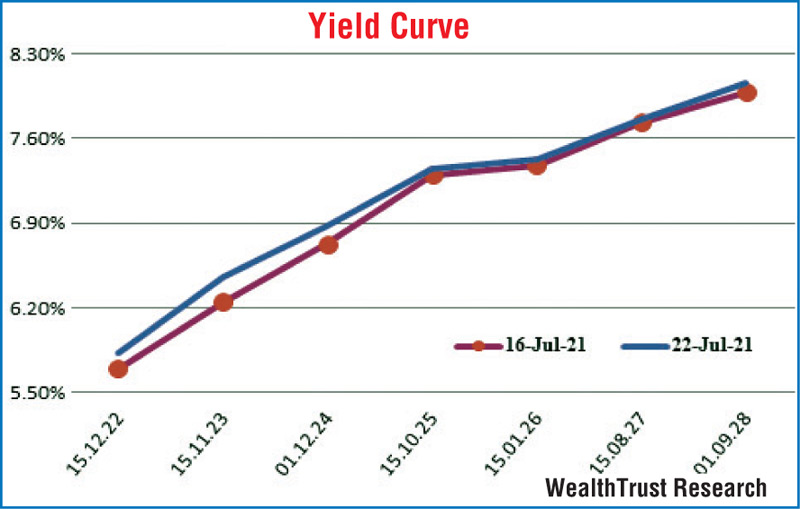

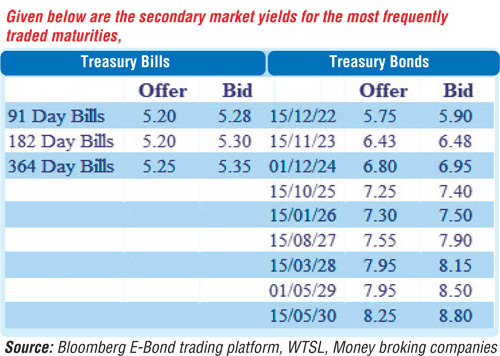

The sharp drop in money market liquidity coupled with an observant approach by most market participants ahead of Rs. 120 billion in Treasury bond auctions scheduled for 29 July saw yields on the liquid maturities of 15.11.23 and 01.12.24 increase to weekly highs of 6.45% and 6.77% respectively against its previous weeks closing levels of 6.23/27 and 6.70/75. In addition, maturities of 15.05.23 and 15.09.24 traded at levels of 5.95% and 6.65% respectively as well during the week.

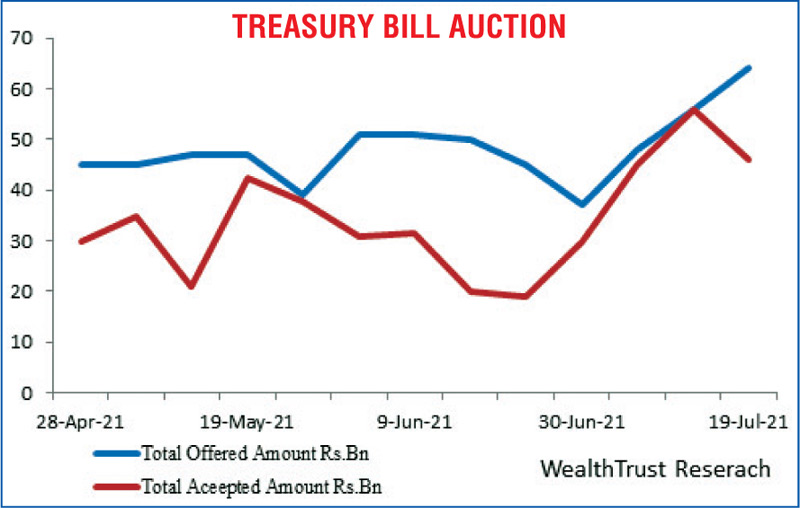

The upward and lacklustre sentiment was further supported by the reduction in the total accepted volume at the weekly bill auction to a four-week low of 72.10% of its total offered amount and against its previous weeks 100%.

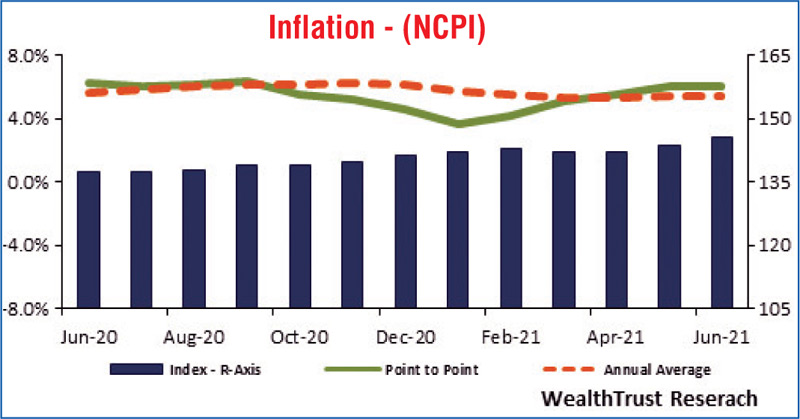

The foreign holding in Rupee bonds remained steady for a second consecutive week at Rs. 2.49 billion for the week ending 20 July while the National Consumer Price Index (NCPI) for the month of June remained steady at 6.1% and 5.4% respectively on its point to point and annualised average.

The daily secondary market Treasury bond/bill transacted volumes for the first two trading days of the week averaged Rs. 32.63 billion.

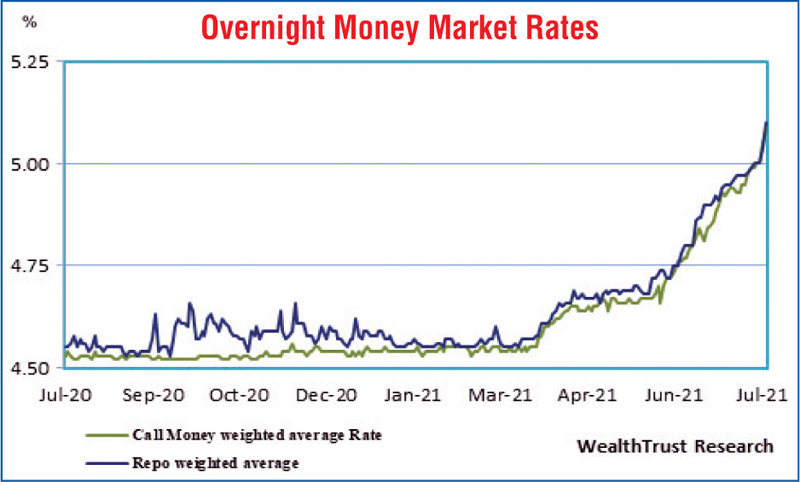

In money markets, the sharp drop in the total outstanding liquidity surplus to a 17-month low of Rs. 0.03 billion by the end of the week from its previous weeks Rs. 61.77 billion led to weighted average rates on overnight call money and repos increasing to average 5.04% and 5.05% respectively for the week against its previous weeks 4.98% and 4.99%. The CBSL’s holding of Gov. Security’s increased to Rs. 922.09 billion.

USD/LKR

The Forex market continued to remain inactive during the week.

The daily USD/LKR average traded volume for the first two trading days of the week stood at $ 50.13 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)