Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 1 November 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

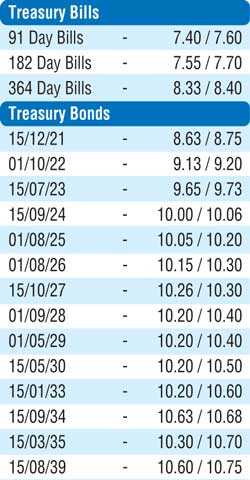

Secondary bond market yields were seen increasing yesterday as the liquid maturities of 15.07.23,  three 2024’s (i.e. 15.03.24, 15.06.24 and 15.09.24), 15.10.27 and 15.09.34 were seen changing hands at highs of 9.60%, 10.00%, 10.05%, 10.02%, 10.30% and 10.65% respectively against its previous day’s closing levels of 9.53/60, 9.90/95, 9.92/97, 9.93/97, 10.24/26 and 10.60/65.

three 2024’s (i.e. 15.03.24, 15.06.24 and 15.09.24), 15.10.27 and 15.09.34 were seen changing hands at highs of 9.60%, 10.00%, 10.05%, 10.02%, 10.30% and 10.65% respectively against its previous day’s closing levels of 9.53/60, 9.90/95, 9.92/97, 9.93/97, 10.24/26 and 10.60/65.

In addition, the maturities of 15.12.21, 15.05.23 and 01.08.25 were traded at levels of 8.70%, 9.70% and 10.05% respectively as well.

Inflation for October increased for a third consecutive month to 5.4% on the basis of its point to point against the previous month’s 5% while its annual average increased to 4% against the previous month’s mark of 3.9%. The total secondary market Treasury bond/bill transacted volume for 29 October was Rs. 9.74 billion.

In money markets, net overnight liquidity surplus stood at Rs. 20.75 billion yesterday as overnight call money and repo rates averaged 7.45% and 7.48% respectively.

Rupee appreciates

In the Forex market, the rupee on spot contracts was seen appreciating for the first time in five days as it was seen closing the day at Rs. 181.20/30 yesterday against its previous day’s closing level of Rs. 181.58/62 on the back of selling interest by banks. The total USD/LKR traded volume for 30 October 2019 was $ 94.72 million. Some of the forward USD/LKR rates that prevailed in the market were one month - 181.70/00; three months - 182.90/20 and six months - 184.80/20.