Sunday Feb 15, 2026

Sunday Feb 15, 2026

Tuesday, 23 January 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth

Trust Securities

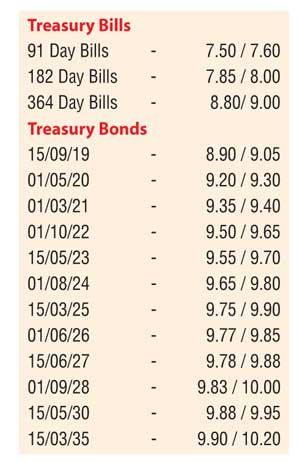

The start of the trading week saw secondary market bond yields increase once again across the curve on the back of moderate volumes changing hands. Selling interest on the 01.05.20, 01.03.21, 01.06.26 and 15.06.27 maturities saw its yields increase to daily highs of 9.35%, 9.40%, 9.80% each respectively against 19 January’s closings of 9.15/20, 9.20/25, 9.66/69 and 9.68/73 as activity dried up towards the latter part of the day.

The total secondary market Treasury bond/bill transacted volumes for 19 January was Rs. 5.5 billion. The surplus liquidity in the money market was seen increasing to Rs. 33.35 billion yesterday as call money and repo averaged 8.16% and 7.54% respectively. The Open Market Operations (OMO) Department of Central Bank was seen draining out liquidity by way of repo auctions and outright sales of Treasury bills on an overnight basis up to 66 days at weighted averages of 7.27% to 7.60%.

Rupee trades

above 154

The USD/LKR rate on spot contracts was seen breaking the psychological level of Rs. 154 yesterday to close the day at Rs 154.05/10 against 19 January’s closing of Rs 153.95/00 on the back of dollar buying interest by banks.

The total USD/LKR traded volume for 19 January was US $ 75.05 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 154.90/05; 3 Months - 156.50/65 and 6 Months - 158.90/10.