Saturday Feb 07, 2026

Saturday Feb 07, 2026

Wednesday, 23 September 2020 01:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities Ltd

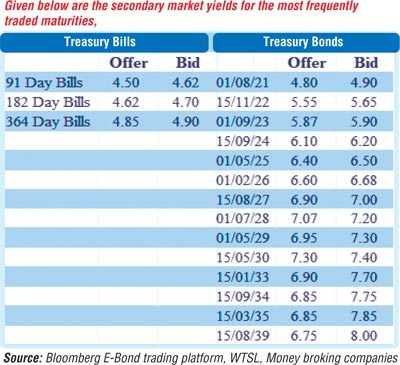

The secondary market bond yields were seen increasing yesterday due to selling interest on the back of moderate trades. The maturities of 2023s (i.e. 15.01.23 and 15.07.23), 2024s (i.e. 15.03.24 and 01.08.24) and 15.10.27 were seen changing hands at levels of 5.60%, 5.83% to 5.85%, 6.10%, 6.20% and 6.94% respectively while two-way quotes were seen increasing and widening on the rest of the yield curve.

Meanwhile, today’s weekly bill auction of Rs. 40 billion will be in focus following the outcome of its previous week’s auction, where only 71.2% was accepted in total against its total offered amount of Rs. 40 billion once again. The Stipulated cutoff rates were set at the previous week’s weighted average rates of 4.51%, 4.64% and 4.88% on the 91 day, 182 day and 364 day maturities respectively. The auction will have on offer Rs. 8 billion of the 91 day, Rs.14 billion of the 182 day and Rs. 18 billion of the 364 day maturities. In secondary bills, 3 and 10 September 2021 maturities were seen changing hands at 4.90% while 1 January 2021 changed hands at 4.60%.

The total secondary market Treasury bond/bill transacted volumes for 21 September 2020 was Rs. 2.35 billion.

In the money market, the weighted average rates of overnight call money and Repos registered at 4.52% and 4.60% respectively as the overnight net liquidity surplus was recorded at Rs. 157.66 billion yesterday. An amount Rs. 160.82 billion was deposited at the Standing Deposit Facility Rate (SDFR) of 4.50% while an amount of Rs. 3.16 billion was drawn down from the Standing Lending Facility Rate (SLFR) of 5.50%.

LKR appreciates marginally

In the Forex market, USD/LKR rate on spot contracts was seen appreciating marginally yesterday to close the day at Rs. 185.35/40 against its previous day’s closing level of Rs. 185.45/52 on the back of selling interest by Banks.

The total USD/LKR traded volume for 21 September was $ 77.76 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)