Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 28 November 2022 00:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary market bond yields were seen fluctuating during the week ending 25 November, firstly decreasing from Monday to Wednesday on expectations of the outcome of the monetary policy announcement, then increasing on Thursday following the announcement and decreasing again late Friday following the bond auction announcement for this week.

The secondary market bond yields were seen fluctuating during the week ending 25 November, firstly decreasing from Monday to Wednesday on expectations of the outcome of the monetary policy announcement, then increasing on Thursday following the announcement and decreasing again late Friday following the bond auction announcement for this week.

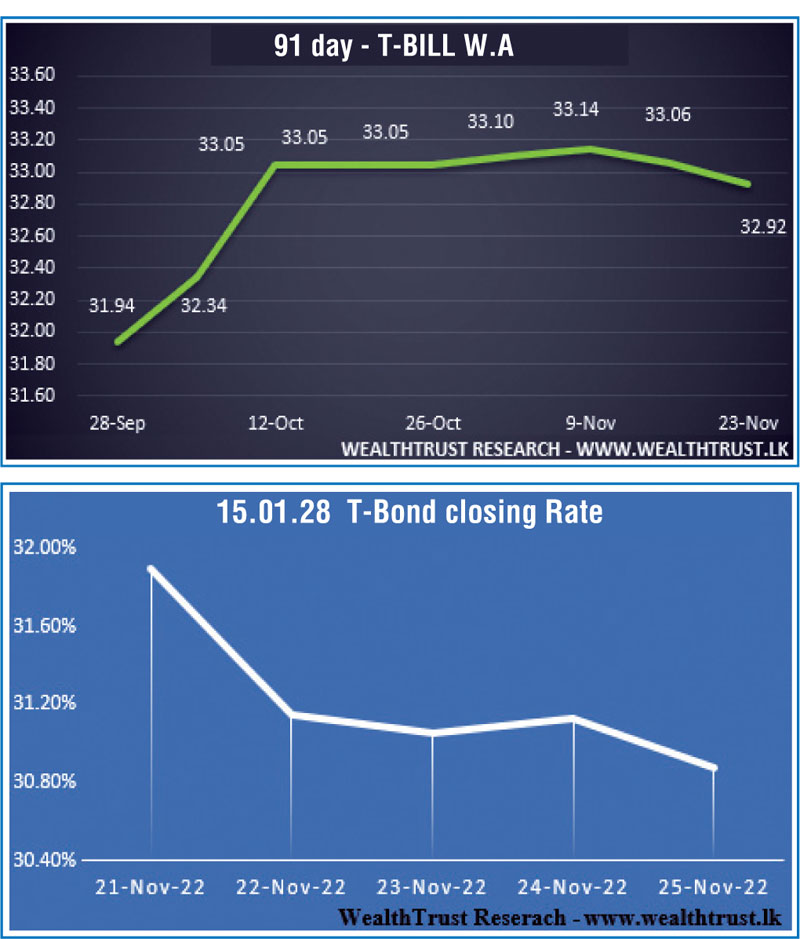

In trading from Monday to Wednesday, yields on the liquid maturities of 01.07.25, 15.01.28 and 01.07.32 decreased to weekly lows of 30.60%, 30.25% and 28.30% respectively against its weeks opening highs of 32.00%, 32.25% and 30.00%. However, selling interest on Thursday following the monetary policy announcement, at where rates were kept unchanged for a third consecutive announcement, led to yields edging up once again to 31.50% and 29.49% on the 01.07.25 and 01.07.32 maturities respectively. Buying interest late Friday saw yields dip once again on the maturities of 15.01.28 and 15.07.29 to 30.00% and 28.95% respectively.

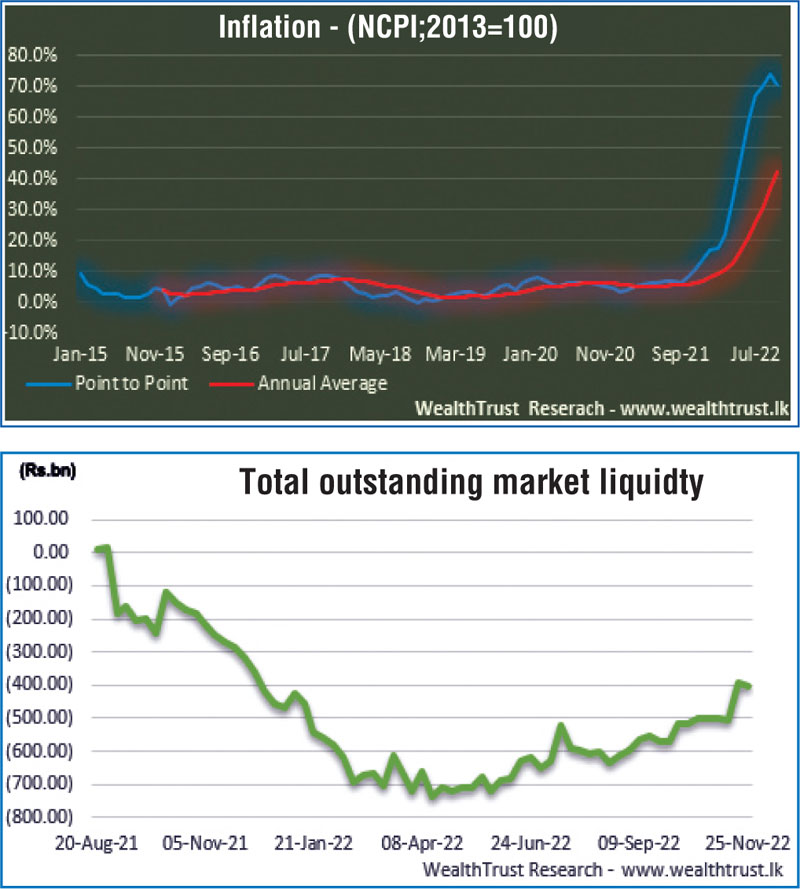

The downward movement in yield was supported by the National Inflation (NCPI) numbers for the month of October 2022 which decreased for the first time in 13 months to register 70.6% on its point to point against 73.7% recorded in September while the weekly Treasury bill auction saw weighted average rates on all three maturities decrease for a second consecutive week.

The foreign holding in rupee bonds remained mostly unchanged at Rs. 24.90 billion for the week ending 23 November. The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 15.80 billion.

In money markets, the total outstanding liquidity deficit was registered at Rs. 401.31 billion by the end of the week against its previous week’s of Rs. 390.97 billion while CBSL’s holding of Government Securities stood at Rs. 2,544.49 billion against its previous week’s of Rs. 2,559.61 billion.

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts appreciated marginally during the week to close the week at Rs. 363.00 against its previous week’s closing of Rs. 363.50.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 36.49 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)