Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 11 October 2022 00:21 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

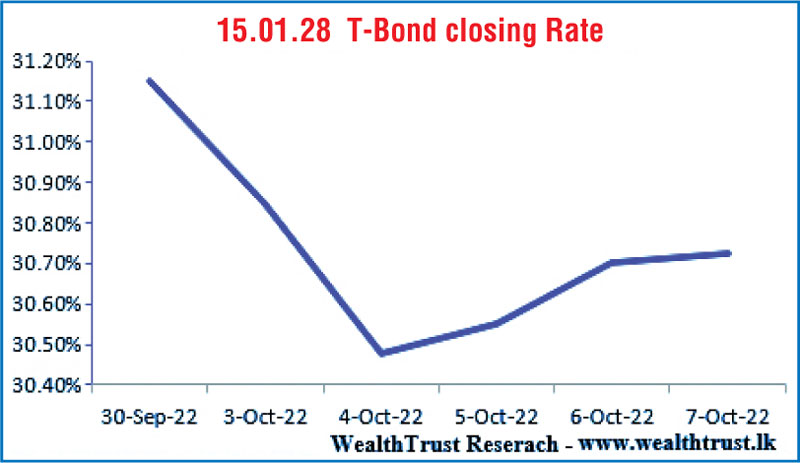

The secondary bond market yields fluctuated during the week ending 7 October, initially decreasing during the first half of the week and then edging up marginally towards the latter part of the week.

The secondary bond market yields fluctuated during the week ending 7 October, initially decreasing during the first half of the week and then edging up marginally towards the latter part of the week.

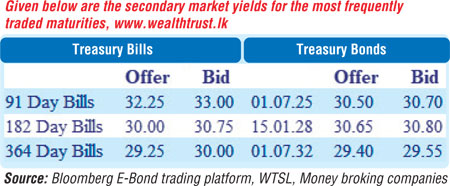

The expectations on the outcome of the monetary policy announcement led to yields on the liquid maturities of two 2025’s (i.e., 01.06.25 and 01.07.25), 15.01.28 and 01.07.32 decreasing to weekly lows of 30.40% each and 29.25% respectively against its opening highs of 30.70%, 30.90%, 31.03% and 29.52%. However, selling interest following the monetary policy announcement, at where rates were kept unchanged for a second consecutive announcement saw yields edge up once again to 30.80%, 30.65%, 31.10% and 29.60% on the said maturities before renewed buying interest at these levels curtailing any further upward movement.

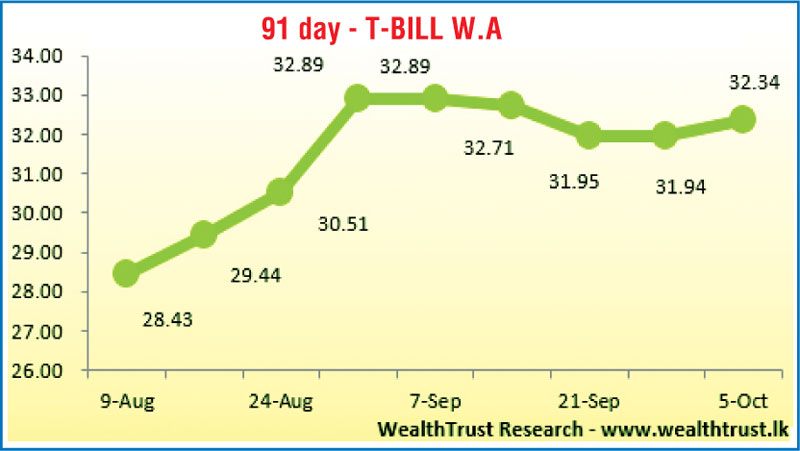

The weekly Treasury bills auction outcome too supported the upward movement in yields as the market favourite 91-day bill weighted average was seen increasing for the first time in five weeks. The total offered amount of Rs. 85 billion was fully subscribed while the second phase was not on offer.

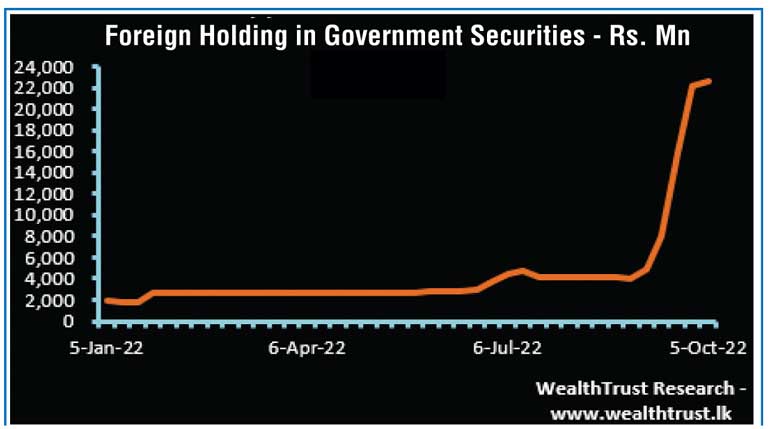

The foreign holding in rupee bonds remained mostly unchanged at Rs. 22.58 billion for the week ending 5 October while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 17.34 billion.

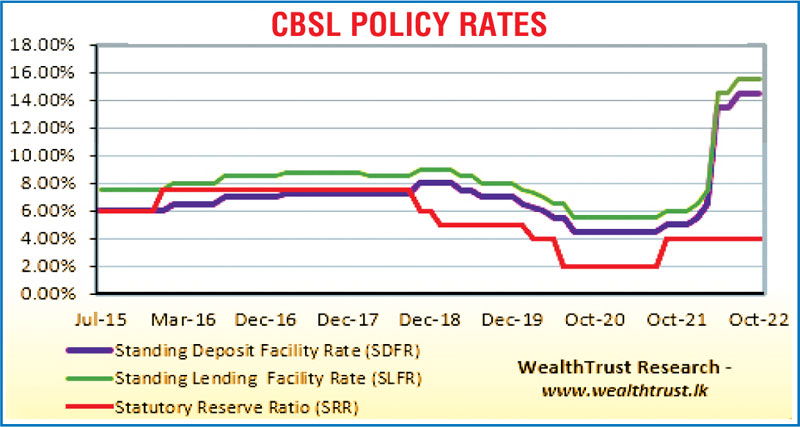

In money markets, the total outstanding liquidity deficit was registered at Rs. 517.43 billion by the end of the week against its previous weeks of Rs. 568.46 billion while the CBSL’s holding of Government Securities stood at Rs. 2,356.52 billion against its previous weeks of Rs. 2,320.40 billion. The weighted average rate on repo was at 15.50% for the week.

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts remained steady for a third consecutive week at 362.90 throughout the week.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 45.96 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)