Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 13 January 2020 08:49 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market ended the week of 9 January 2020 on a positive note subsequent to fluctuating during the week.

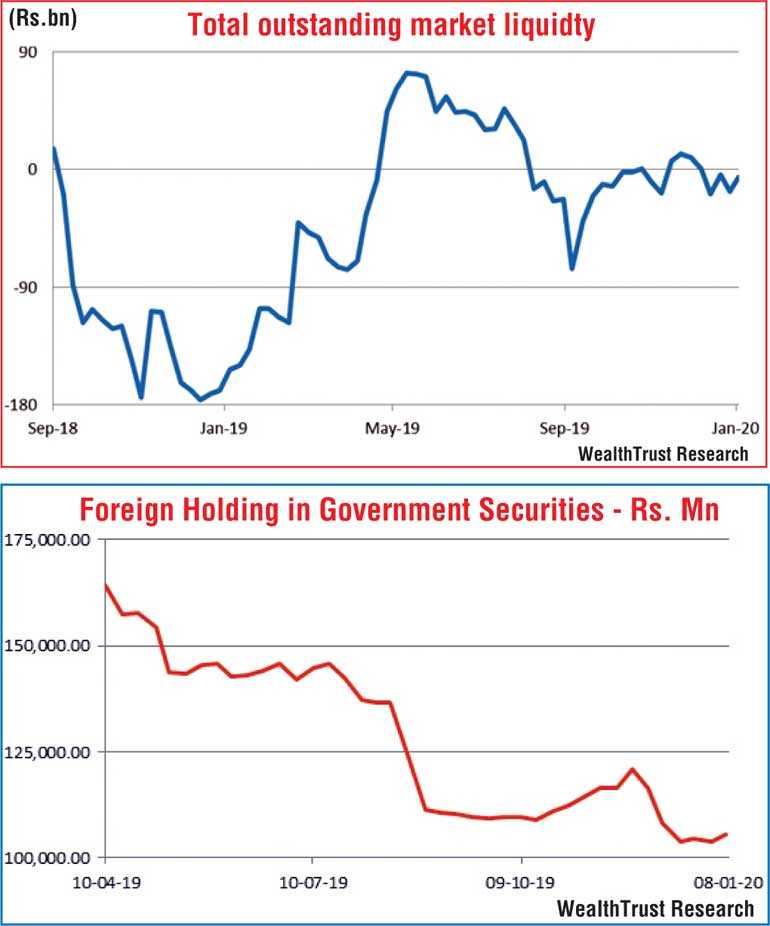

Yields were seen increasing during the first half of the week on the back of selling interest, which was further complemented by the increase in the weekly Treasury bill weighted averages, and decreased towards the latter part of the week on renewed buying interest to pare most of its weeklong increases but close the week marginally higher than its previous week’s closings.

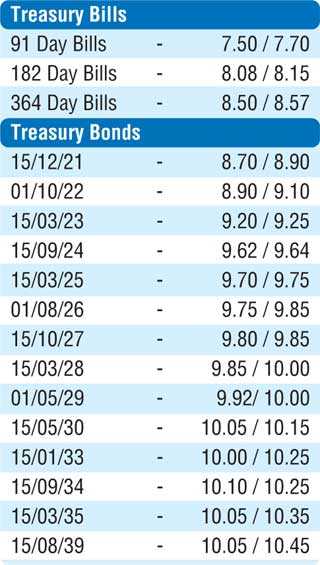

Yields on the liquid maturities of 15.03.23, two 2024’s (i.e. 15.06.24 and 15.09.24) and 15.10.27 were seen increasing to weekly highs of 9.28%, 9.75% each and 9.85% respectively against its week’s opening lows of 9.20%, 9.57%, 9.58% and 9.78%. The decline from this point onwards saw yields on the liquid maturities of 15.03.23 and two 2024’s (i.e. 15.06.24 and 15.09.24) dip to lows of 9.22% and 9.63% each once again. In addition, the 01.05.29 and 15.05.30 maturities were seen changing hands at levels of 9.97% to 9.99% and 10.15% as well.

The first Treasury bond auctions for 2020 will have in total an amount of Rs. 30 billion on offer consisting of Rs. 15 billion each on a new three year and eight month maturity of 01.09.23 and a 10 year and four month maturity of 15.05.30. The weighted average yields at the auctions conducted on 12 December 2019 for the maturities of 15.09.2024 and 15.05.2030 were recorded at 9.87% and 10.23% respectively.

Foreign holdings in rupee bonds were seen increasing, recording an inflow of Rs. 1.50 billion for the week ending 8 January 2020.

The daily secondary market Treasury bond/bills transacted volume for the first three days of the week averaged Rs. 11.14 billion.

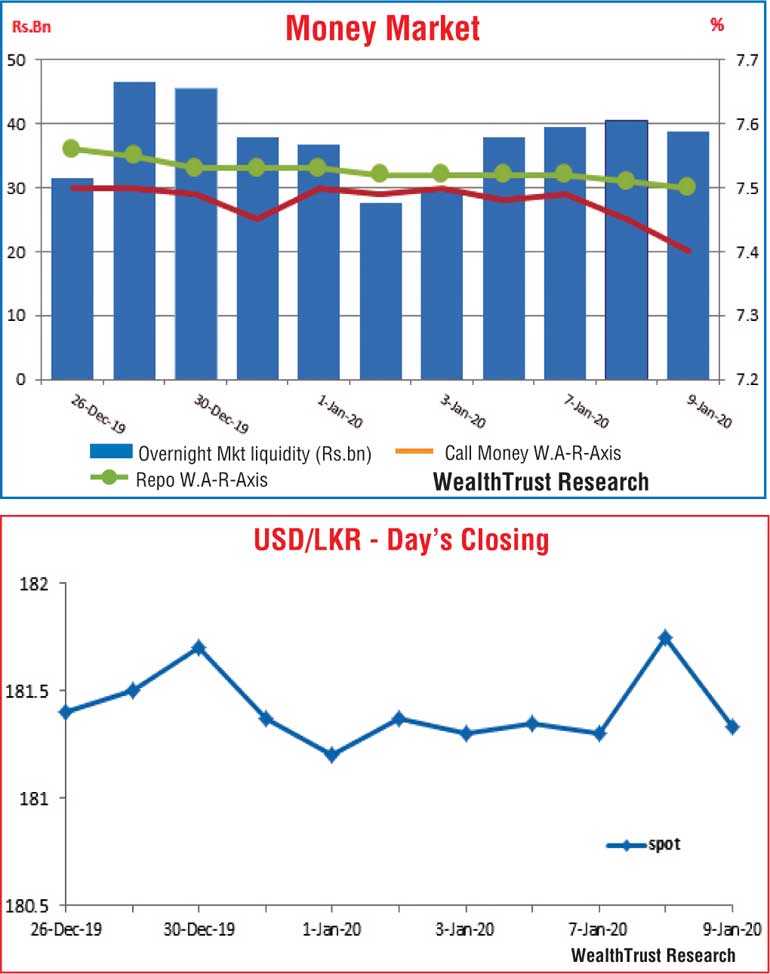

In money markets, the Domestic Operations Department (DOD) of the Central Bank injected liquidity during the early part of the week on an overnight basis and term basis (14 days) at weighted average yields ranging from 7.50% to 7.52% while it drained out liquidity during the latter part of the week on an overnight basis at a weighted average rate of 7.45%. The overall net deficit in the system improved to Rs. 6.24 billion against its previous week’s deficit of Rs. 16.70 billion as well. The overnight call money and repo rates averaged 7.46% and 7.51% respectively for the week.

Rupee fluctuates

The USD/LKR rate on spot contracts in the Forex market was seen trading within a high of Rs. 181.20 and a low of Rs. 181.75 during the week before closing the week broadly steady at Rs. 181.30/35 in comparison to its previous week’s closing.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 99.06 million.

Some of the forward dollar rates that prevailed in the market were one month - 181.80/95; three months - 182.80/00 and six months - 184.35/65.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)