Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 26 October 2020 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

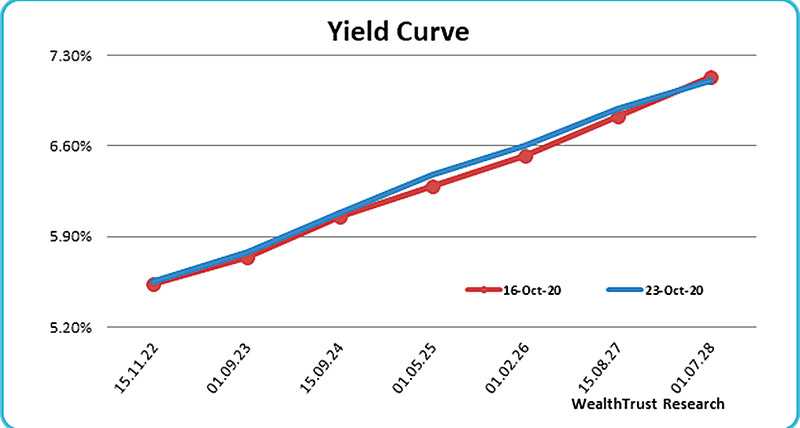

The secondary bond market yields were seen fluctuating during the week ending 23 October, holding steady during the first half of the week leading to the monitory policy announcement, increasing subsequent to the announcement on Thursday, at where policy rates were held unchanged, and reducing once again on Friday.

The secondary bond market yields were seen fluctuating during the week ending 23 October, holding steady during the first half of the week leading to the monitory policy announcement, increasing subsequent to the announcement on Thursday, at where policy rates were held unchanged, and reducing once again on Friday.

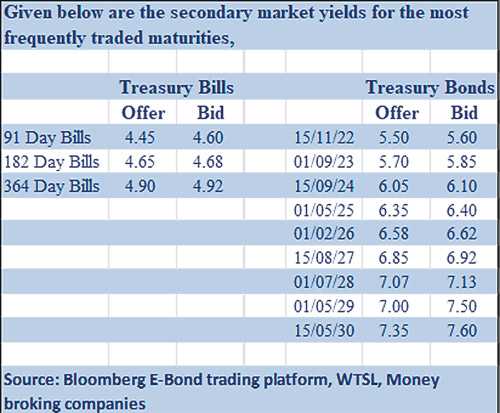

Trades were mainly seen on the maturities of 15.12.22, 15.09.24, 01.05.25, two 2026’s (i.e. 01.02.26 & 01.08.26), 15.10.27, and 01.07.28 as its yields were seen increasing from its weeks lows of 5.53%, 6.02%, 6.30%, 6.50% each, 6.87%, and 7.07%, respectively, to weekly highs of 5.60%, 6.10%, 6.40%, 6.68%, 6.75%, 6.93%, and 7.15%. Yields trimmed most of its increase once again on the back of renewed demand, but still closed the week higher than its previous week’s closings, registering a marginal upward shift of the yield curve.

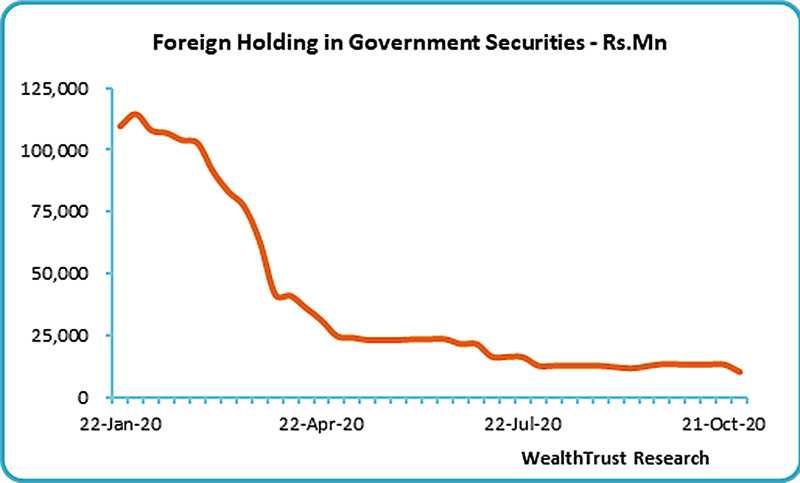

Furthermore, the foreign holding in rupee bonds decreased once again, recording an outflow of Rs. 3.01 billion for the week ending 21 October.

In the secondary Treasury bill market, demand towards the latter part of the week saw yields dip as September and October 2021 maturities dipped to weekly lows of 4.55% and 4.85%, respectively, from its week’s highs of 4.85% and 4.97%.

The daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 12.31 billion.

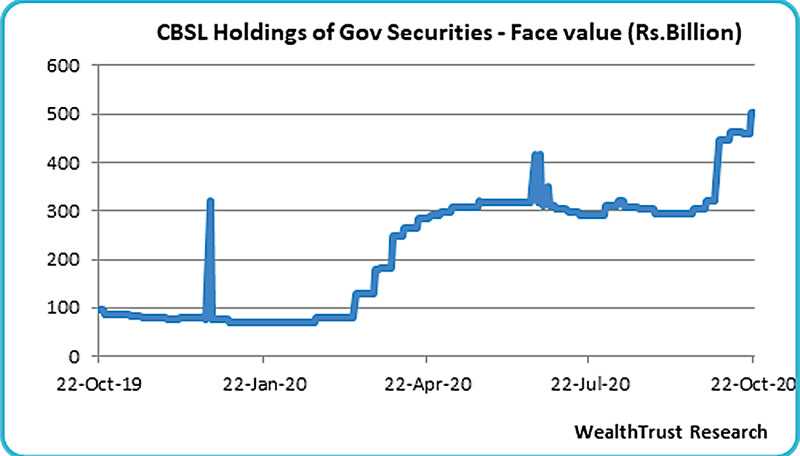

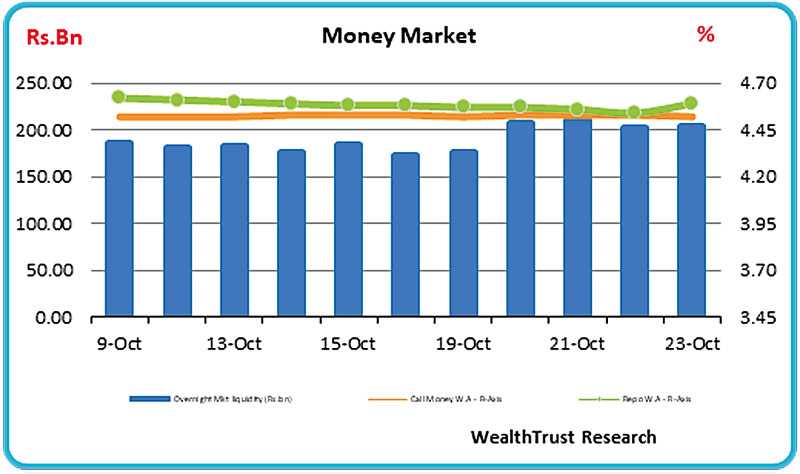

In the money market, the average net overnight surplus liquidity increased to Rs. 200.23 billion for the week against its previous week of Rs. 179.99 billion with the weighted average rates on overnight call money and repo registering at 4.53% and 4.57%, respectively, for the week. The CBSL’s holding of Gov. Securities was seen crossing the Rs. 500 billion level to register Rs. 501.66 billion on Tuesday before closing the week marginally lower at Rs. 491.66 billion.

Rupee fluctuates

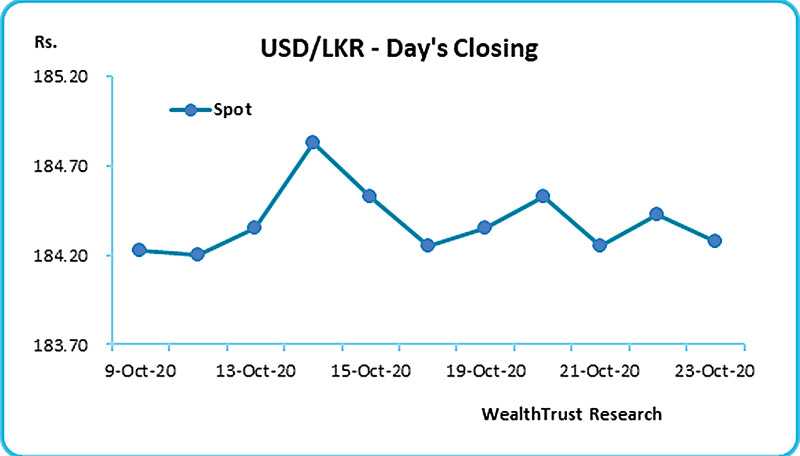

In the Forex market, USD/LKR rate on spot contracts fluctuated during the week with it changing hands within the range of Rs. 184.15 to Rs. 184.75 during the week before closing the week mostly unchanged at Rs. 184.20/35.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 89.33 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)