Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 24 July 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

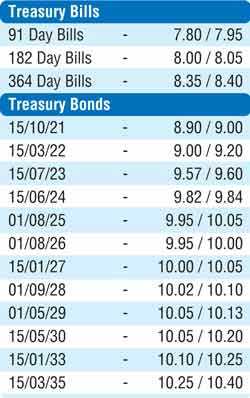

The secondary bond market yields traded within a narrow range yesterday subsequent to edging up in morning hours of trading ahead of today’s weekly Treasury bill auction. At the auction, a total amount of Rs. 25 billion will be  on offer, consisting of Rs. 3 billion of the 91 day bill, Rs. 4 billion of the 182 day bill and a further Rs. 18 billion of the 364 day bill maturity. At last week’s auction, the weighted averages decreased across the board by 10, 12 and 08 basis points to 7.99%, 8.09% and 8.46% on the 91 day, 182 day and 364 day maturities respectively.

on offer, consisting of Rs. 3 billion of the 91 day bill, Rs. 4 billion of the 182 day bill and a further Rs. 18 billion of the 364 day bill maturity. At last week’s auction, the weighted averages decreased across the board by 10, 12 and 08 basis points to 7.99%, 8.09% and 8.46% on the 91 day, 182 day and 364 day maturities respectively.

In the secondary bond market, yields on the liquid maturities of 2021s (i.e. 15.10.21 & 15.12.21) and 2024s (i.e. 15.03.24, 15.06.24 & 01.08.24) were seen increasing to intraday highs of 9.03%, 9.00%, 9.80%, 9.85% and 9.95% respectively while buying interest at these levels curtailed any further upward movement to trade within a narrow range. Furthermore, activity was also witnessed on the maturities of 15.03.22, 01.08.25 and 15.01.27 at levels of 9.10%, 9.98% to 10.00% and 10.00% respectively.

The total secondary market Treasury bond/bill transacted volumes for 22 July was Rs. 8.16 billion.

In money markets, the overnight call money and repo rates averaged 7.80% and 7.87% respectively as the overnight net liquidity surplus stood at Rs. 40.04 billion yesterday.

Rupee dips to Rs. 176

In the Forex market, the USD/LKR rate on spot contracts depreciated further to close the day at a low of Rs. 176.00/10 against its previous day’s closing level of Rs. 175.90/05 on the back of continued importer demand.

The total USD/LKR traded volume for 22 July was $56.15 million.

Some forward USD/LKR rates that prevailed in the market were: 1 month - 176.60/70; 3 months - 177.85/00; 6 months - 179.90/10.