Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 17 April 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market saw activity pick up yesterday as yields decreased following the news of talks between the Government of Sri Lanka and the International Monetary Fund (IMF) for a Rapid  Credit Facility.

Credit Facility.

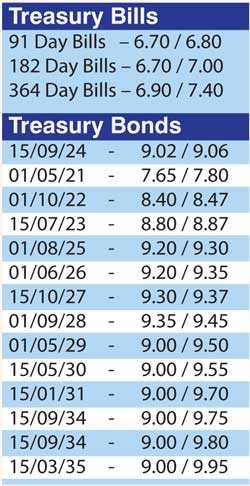

Buying interest on the short to belly end of the curve saw yields on the liquid maturities of 01.10.22, 2023s (i.e. 15.03.23, 15.07.23 and 15.12.23) and 2024s (i.e. 15.06.24, 01.08.24 and 15.09.24) dip to intraday lows of 8.45%, 8.85%, 8.86%, 8.95%, 9.04%, 9.12% and 9.05% respectively against its previous days closings of 8.40/50, 8.85/95,8.90/92, 8.95/03, 9.10/15, 9.15/20, 9.07/15.

In money markets, the weighted average rates on overnight call money and repo stood at 6.50% and 6.57% respectively as the overnight net liquidity surplus increased to Rs. 84.94 billion yesterday.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight reverse repo auction for an amount of Rs. 1.90 billion at a weighted average of 6.50% subsequent to offering Rs. 10 billion.

Rupee holds steady

In the Forex market, the USD/LKR rate on spot contracts was seen trading within a steady range of Rs. 191.00 to 191.52 yesterday.

The total USD/LKR traded volume for 15 April was $ 38.86 million.

(References: Central Bank of

Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)