Friday Mar 06, 2026

Friday Mar 06, 2026

Friday, 7 August 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Activity in the secondary bond market remained moderate yesterday, with yields decreasing marginally as most market participants were seen on the sidelines.

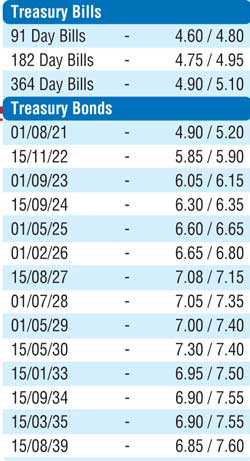

Limited trades were witnessed on the liquid maturities of 2022s (i.e.15.11.22 and 15.12.22), 2023’s (i.e.15.01.23 and 01.09.23) and 15.09.24 at levels of 5.90%, 5.90% to 5.93%, 5.92% to 5.95%, 6.12% to 6.15% and 6.31% to 6.32% respectively against its previous day’s closing levels of 5.90/00, 5.95/00, 6.00/05, 6.10/25 and 6.30/40 while 01.08.25, 01.02.26 and 15.10.27 maturities traded at levels of 6.68%, 6.65% and 7.10% to 7.11% respectively.

In the secondary bill market, August 2020 and November 2020 bills were traded at levels of 4.55% and 4.75% to 4.80% respectively.

The total secondary market Treasury bond/bill transacted volumes for 5 August was Rs.2.45 billion.

In money markets, weighted average rates of overnight call money and repo stood at 4.54% and 4.58% respectively as the net surplus liquidity in the system increased to Rs.166.08 billion yesterday.

Rupee continues to appreciate

In the Forex market, USD/LKR rate on spot contracts were seen appreciating further to hit a high of Rs.185.40 yesterday against its previous day’s closing level of Rs.185.46/54. It closed the day at Rs.185.40/48.

The total USD/LKR traded volume for 5 August was $ 38.05 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)