Saturday Feb 14, 2026

Saturday Feb 14, 2026

Wednesday, 3 March 2021 00:00 - - {{hitsCtrl.values.hits}}

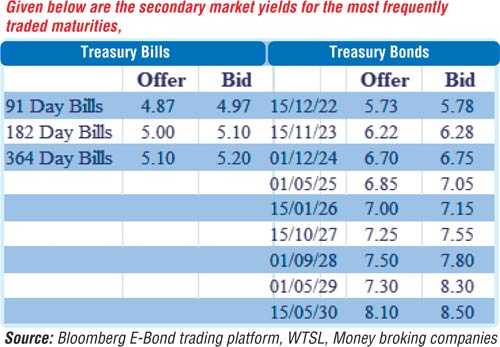

The secondary bond market yields were seen decreasing yesterday ahead of today’s weekly T-Bill auction. Buying interest on the 2022’s (i.e. 01.10.22 and 15.12.22), 2023’s (i.e. 01.09.23, 15.11.23 and 15.12.23) and 2024’s (i.e. 15.09.24 and 01.12.24) saw its yields decrease to 5.71%, 5.73%, 6.25%, 6.26% each, 6.70% and 6.72% respectively against its previous day’s closing level of 5.72/80, 5.80/85, 6.30/35 each, 6.33/40, 6.75/80 and 6.78/85. In addition, maturities of 15.01.23, 01.01.24 and two 2026’s (i.e. 15.01.26 and 01.02.26) changed hands at levels of 5.86%, 6.42% and 7.05% each respectively as well.

The secondary bond market yields were seen decreasing yesterday ahead of today’s weekly T-Bill auction. Buying interest on the 2022’s (i.e. 01.10.22 and 15.12.22), 2023’s (i.e. 01.09.23, 15.11.23 and 15.12.23) and 2024’s (i.e. 15.09.24 and 01.12.24) saw its yields decrease to 5.71%, 5.73%, 6.25%, 6.26% each, 6.70% and 6.72% respectively against its previous day’s closing level of 5.72/80, 5.80/85, 6.30/35 each, 6.33/40, 6.75/80 and 6.78/85. In addition, maturities of 15.01.23, 01.01.24 and two 2026’s (i.e. 15.01.26 and 01.02.26) changed hands at levels of 5.86%, 6.42% and 7.05% each respectively as well.

Today’s auction will have on offer a total amount of Rs. 45 billion, consisting of Rs. 7.5 billion of the 91-day, Rs. 12.5 billion of the 182-day and Rs. 25 billion of the 364-day maturities. At last week’s auction, weighted average rates on the 91-day and 182-day maturities increased by eight and six basis points respectively to 4.90% and 4.99% while the weighted average rate on the 364-day maturity remained steady at 5.09%. The maximum yield rate for acceptance on the 364-day maturity was increased by one basis point to 5.10% this week, while the yield rates of the 91-day and 182-day maturities will be decided below the level of the 364-day maturity at the auction. The total secondary market Treasury bond/bill transacted volume for 1 March was Rs. 4.07 billion.

In the money market, the weighted average rates on call money and repo were registered at 4.55% and 4.57% respectively as the overnight surplus liquidity stood at Rs. 177.18 billion yesterday.

USD/LKR

In Forex markets, the USD/LKR rate on spot contracts was seen trading at level of Rs. 195 while the more active one-week forward contracts were seen closing the day at Rs. 196.50/197.50 yesterday against its previous day’s closing level of Rs. 195.50/196.

The total USD/LKR traded volume for 1 March was $ 53.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)