Tuesday Mar 03, 2026

Tuesday Mar 03, 2026

Monday, 8 February 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The shortened trading week ending 5 February saw secondary market bond yields continue its upward trend for a third consecutive week driven by the outcome of the weekly Treasury bill auction where the total subscribed amount was seen falling short of its total offered amount for a second consecutive week. It accepted only an amount of Rs. 22.75 billion in total, against its previous week’s total accepted amount of Rs. 25 billion and against a total offered amount of Rs. 40 billion each week.

The shortened trading week ending 5 February saw secondary market bond yields continue its upward trend for a third consecutive week driven by the outcome of the weekly Treasury bill auction where the total subscribed amount was seen falling short of its total offered amount for a second consecutive week. It accepted only an amount of Rs. 22.75 billion in total, against its previous week’s total accepted amount of Rs. 25 billion and against a total offered amount of Rs. 40 billion each week.

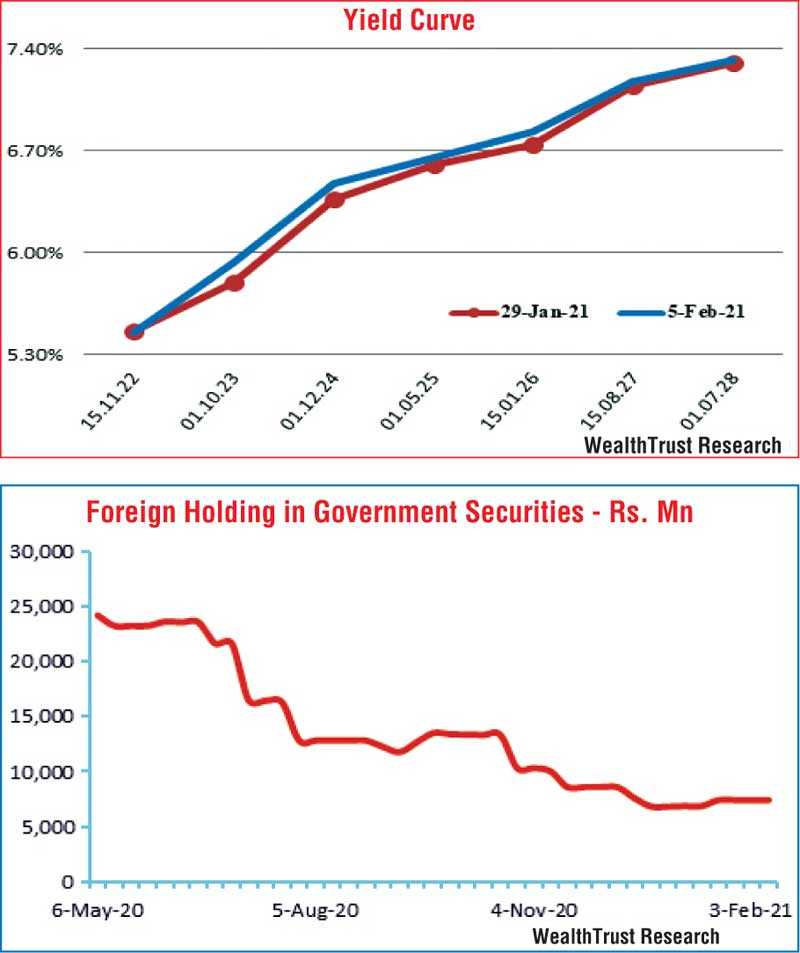

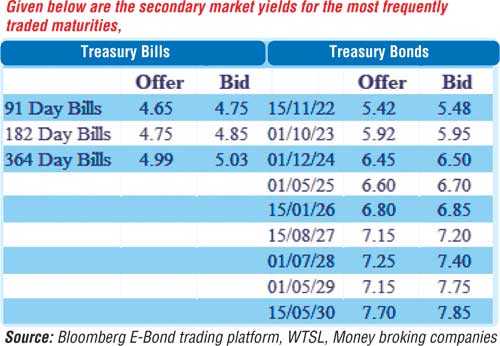

The liquid maturities of 2022’s (i.e. 01.10.22 and 15.12.22), 2023’s (i.e. 01.10.23 and 15.12.23), 2024’s (i.e. 15.09.24 and 01.12.24) and 15.08.27 saw its yields increasing to weekly highs of 5.43%, 5.46%, 5.94%, 5.95%, 6.40%, 6.47% and 7.185% respectively in comparison to its previous weeks closing levels of 5.40/45, 5.42/50, 5.75/85, 5.80/88, 6.30/35, 6.35/38 and 7.10/18, reflecting a upward shift of the overall yield curve.

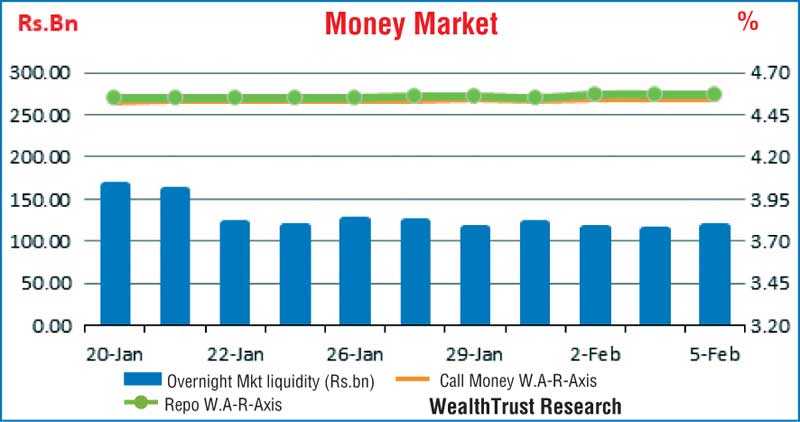

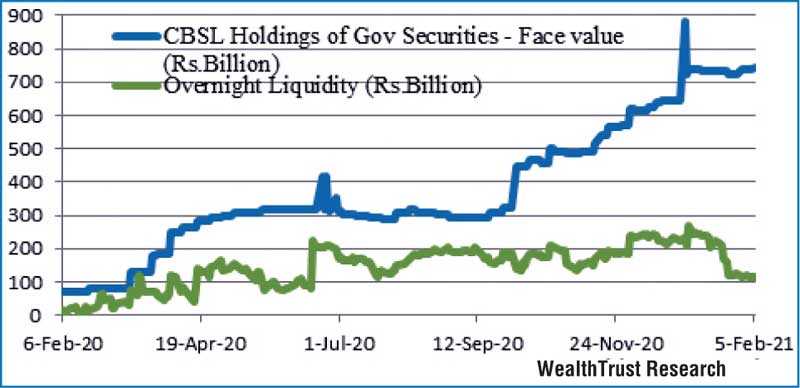

In addition, maturities of 2021’s (i.e. 01.05.21 and 01.08.21), 15.11.22, 15.01.23, 01.09.23, 2026’s (i.e. 15.01.26, 01.02.26 and 01.08.26) and 15.10.27 traded at levels of 4.67% to 4.80%, 5.40% to 5.41%, 5.45% to 5.48%, 5.90% to 5.91%, 6.80% to 6.84% and 7.15% to 7.153% respectively as well while April, February and June 2021 bill maturities were seen changing hands at 4.58%, 4.65% and 4.78% respectively in the secondary market. The foreign holding in rupee bonds remained mostly unchanged at Rs. 7.42 billion. The daily secondary market Treasury bond/bill transacted volumes for the three four trading days of the week averaged Rs. 9.71 billion. In money markets, both the total outstanding market liquidity and the CBSL’s holding of Government securities increased marginally to Rs. 116.49 billion and Rs. 744.71 billion respectively. The weighted average rates on overnight call money and repo remained mostly unchanged to average 4.55% and 4.57% respectively for the week.

Rupee depreciates marginally

In the Forex market, the rupee on spot contracts closed the week lower at Rs. 193.50/194.50 in comparison to its previous weeks closing levels of Rs. 191.00/192.00 subsequent to hitting an intraweek low of Rs. 195.50 and a high of Rs. 191.50.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 81.40 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)