Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 3 May 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

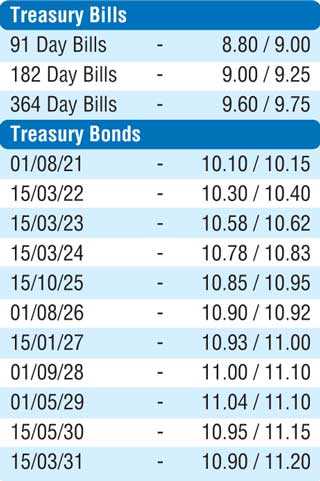

The sentiment in the secondary bond market remained positive yesterday as buying interest continued across the yields curve. The liquid 2023s (i.e. 15.03.23, 15.05.23, 15.07.23, 01.09.23 and 15.12.23), 15.03.24, 01.08.26 and  15.01.27 were seen dipping to intra-day lows of 10.58%, 10.65% each, and 10.70% each, 10.78%, 10.90% and 10.95% respectively against its previous day’s closing levels of 10.60/65, 10.65/75, 10.70/80, 10.70/80, 10.73/83, 10.82/85, 10.90/95 and 10.95/00. In addition, buying interest on the 01.05.20, 2021’s (i.e. 01.08.21 and 15.12.21) and 01.10.22 saw it change hands within the range of 9.75% to 9.78%, 10.10% to 10.20% and 10.44% to 10.50% as well. The total secondary market Treasury bond/bill transacted volumes for 30 April was Rs. 36.18 billion.

15.01.27 were seen dipping to intra-day lows of 10.58%, 10.65% each, and 10.70% each, 10.78%, 10.90% and 10.95% respectively against its previous day’s closing levels of 10.60/65, 10.65/75, 10.70/80, 10.70/80, 10.73/83, 10.82/85, 10.90/95 and 10.95/00. In addition, buying interest on the 01.05.20, 2021’s (i.e. 01.08.21 and 15.12.21) and 01.10.22 saw it change hands within the range of 9.75% to 9.78%, 10.10% to 10.20% and 10.44% to 10.50% as well. The total secondary market Treasury bond/bill transacted volumes for 30 April was Rs. 36.18 billion.

In money markets, the overnight net surplus liquidity was seen increasing to over a two year high of Rs. 69.65 billion yesterday, a level seen for the first time since 19 January 2017. Overnight call money and repo rates averaged at 8.50% and 8.67% respectively.

Rupee continues to dip

The USD/LKR rate on the one week forward contract was seen depreciating further to close the day at Rs.177.10/30 against its previous weeks closing of Rs. 176.50/70 on the back of continued buying interest by banks.The total USD/LKR traded volume for 30 April was $83.30 million

Some of the forward USD/LKR rates that prevailed in the market were one month - 178.15/45; three months - 180.10/40 and six months - 183.00/40.