Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 17 June 2020 01:15 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yields closed broadly steady yesterday ahead of the weekly Treasury bill auctions due today.

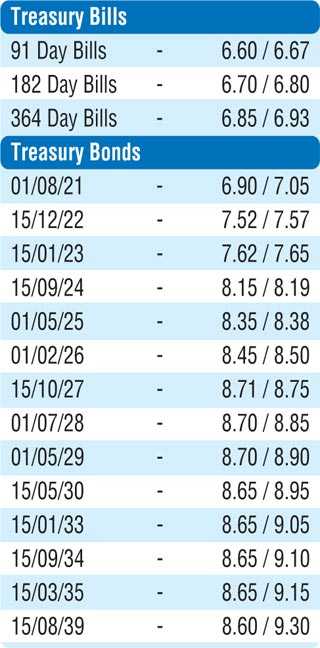

Trades were seen on the maturities of 15.12.20, 15.12.22, 2023’s (i.e. 15.01.23, 01.09.23 and 15.12.23), 2024’s (i.e. 15. 06.24 and 15.09.24), 01.02.26 and 01.07.28 at levels of 6.85%, 7.50% to 7.54%, 7.60% to 7.62%, 8.17% to 8.18%, 8.15% to 8.17%, 8.45% to 8.47% and 8.76% to 8.80% respectively.

In the secondary bill market, June to July, September and May 2021 maturities changed hands at 6.45% to 6.53%, 6.61% to 6.65% and 6.90% respectively.

Today’s bill auction will have on offer a total amount of Rs. 23 billion consisting of Rs. 8 billion of the 91-day bill maturity, Rs. 3 billion of the 182-day maturity and a further Rs. 12 billion of the 364-day maturity. At last week’s auction, the weighted average yields decreased across the board to 6.67%, 6.78% and 6.925% respectively.

The total secondary market Treasury bond/bill transacted volume for 15 June was Rs. 17.30 billion.

In money markets, the weighted average rates on the overnight call money and repo rates were recorded at 5.78% and 5.87% respectively as the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka was seen injecting an amount of Rs. 5 billion for Standalone Primary Dealers by way of a six-day reverse repo auction at a weighted average rate of 6.50%. The overnight net liquidity surplus in the system stood at Rs. 80.02 billion yesterday.

Rupee loses further

In Forex markets, continued buying interest by banks saw the USD/LKR on spot contracts depreciate further yesterday to close the day at Rs. 186.00/30 against its previous day’s closing levels of Rs. 185.85/00.

The total USD/LKR traded volume for 15 June was $ 95.94 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)