Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 19 October 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

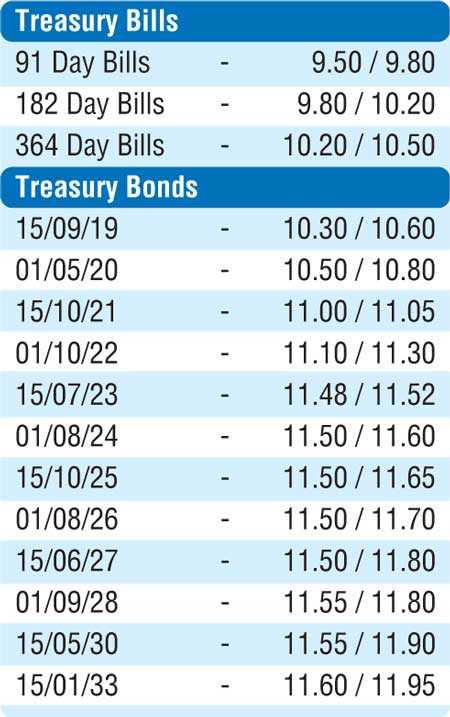

The secondary bond market yields were seen fluctuating yesterday as selling interest during morning hours of trading saw the yield on the five-year maturity of 15.07.23 increase to an intraday high of 11.59% against its previous day’s closing of 11.45/52. Buying interest at these levels led to its yield decreasing once again to hit an intraday low of 11.47% and close the day at 11.48/52. In addition, 01.03.21, 15.10.21 and 15.03.23 maturities were seen changing hands at levels of 11.00%, 11.05% and 11.45% to 11.52%, respectively, as well.

The total secondary market Treasury bond/bill transacted volume for 17 October was Rs. 18.09 billion.

In the money market, the OMO Department of Central Bank injected liquidity by way of an overnight and a seven-day term repo auction for amounts of Rs. 12 billion and Rs. 10 billion, respectively, at weighted averages of 8.36% and 8.41% as the net liquidity shortfall stood at Rs. 28.08 billion yesterday. The call money and repo averaged 8.46% and 8.42%, respectively.

Rupee continues to slide down

The rupee on its spot contracts depreciated further yesterday by around 30 cents to close the day at levels of Rs. 171.30/45 against its previous day’s closing levels of Rs. 171.00/05 on the back of continued importer dollar demand and a globally strengthening dollar.

The total USD/LKR traded volume for 17 October was $ 119.41 million. Some of the forward USD/LKR rates that prevailed in the market were 1 month – 172.30/70, 3 months – 174.40/80, and 6 months – 177.40/80.