Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 11 February 2020 00:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

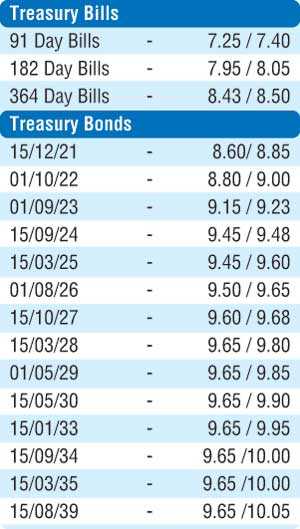

The commencement of a fresh trading week saw the sentiment in the secondary bond market turn bearish as limited trades were witnessed yesterday. Yields across the board were seen  closing the day broadly steady following four consecutive days of increases during the previous week. The maturities of 15.10.21, 2024s (i.e. 01.01.24, 15.06.24, 01.08.24 & 15.09.24) and 15.10.27 changed hands at levels of 8.75%, 9.40% to 9.45%, 9.45% to 9.55%, 9.48% to 9.58%, 9.45% and 9.65% respectively.

closing the day broadly steady following four consecutive days of increases during the previous week. The maturities of 15.10.21, 2024s (i.e. 01.01.24, 15.06.24, 01.08.24 & 15.09.24) and 15.10.27 changed hands at levels of 8.75%, 9.40% to 9.45%, 9.45% to 9.55%, 9.48% to 9.58%, 9.45% and 9.65% respectively.

In the secondary bill market, July 2020 and August 2020 maturities traded at levels of 7.97% and 7.98% to 8.13% respectively.

The total secondary market Treasury bond/bill transacted volume for 7 February was Rs.10.1 billion. Meanwhile in money markets, the weighted average yield on the overnight call money and repo rates stood at 6.99% and 7.04% respectively as the overnight net liquidity surplus in the system increased to Rs.17.80 billion yesterday.

The Domestic Operations Department (DOD) of the Central Bank of Sri Lanka injected an amount of Rs. 5.75 billion on an overnight basis by way of Reverse Repo auction at a weighted average rate of 6.93%. It further injected an amount of Rs. 3 billion for Standalone Primary Dealers by way of an overnight reverse repo auction at a weighted average rate of 7.07%.

In the Forex market, the USD/LKR rate on spot contracts were seen trading within the range of range of Rs. 181.39 to Rs. 181.46 yesterday before closing the day mostly unchanged at Rs. 181.40/42.

The total USD/LKR traded volume for 7 February was $ 58.10 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 181.85/00; three months – 182.85/05; six months – 184.35/55.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies.)