Sunday Feb 15, 2026

Sunday Feb 15, 2026

Tuesday, 26 February 2019 00:22 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

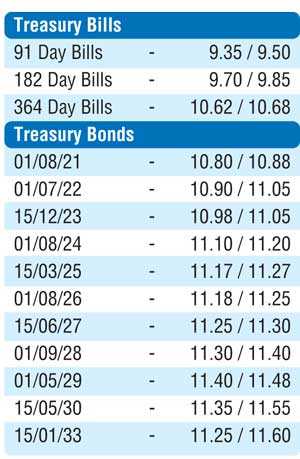

The Secondary bond market commenced the week on a sluggish note yesterday as yields remained broadly unchanged. Limited trades consisting of the two 2021’s (i.e. 01.05.21 & 01.08.21), 15.03.23, 15.06.27 and 01.05.29 maturities were seen at levels of 10.80% to 10.85%, 10.85%, 11.05%, 11.28% and 11.45% respectively. In the secondary bill market, the 11th October 2019 maturity was seen changing hands at 9.95%

The total secondary market Treasury bond/bill transacted volumes for the 22nd February 2019 was Rs.15.94 billion.

In the money market, the overnight call money and repo rates averaged 8.99% and 9.00% respectively as the OMO Department of Central Bank was seen infusing liquidity by way of an overnight reverse repo auction for a successful amount of Rs.30 billion at a weighted average yield of 8.96%. In addition it injected a further Rs.22.7 billion by way of a four day reverse repo auctions at weighted average of 8.94%. The net liquidity shortfall increased to Rs.100.09 billion yesterday.

Rupee loses marginally

The rupee rate on its spot contract was seen losing marginally yesterday to close the day at Rs.179.65/75 against its previous day’s closing level of Rs.179.55/65 on the back of buying interest by banks and moderate importer demand.

The total USD/LKR traded volume for the 22nd of February 2019 was US $ 53.19 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 180.50/70; 3 Months - 182.35/55 and 6 Months - 185.25/45.