Monday Mar 09, 2026

Monday Mar 09, 2026

Friday, 22 January 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yields were seen closing the day broadly steady yesterday, on the back of moderate activity.

The secondary bond market yields were seen closing the day broadly steady yesterday, on the back of moderate activity.

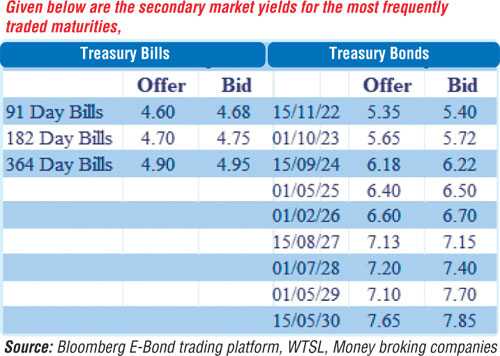

Limited trades were witnessed on the short end of the yield curve consisting of the 2022s (i.e. 01.10.22 and 15.12.22), 15.12.23 and 2024s (i.e. 15.09.24 and 01.12.24) maturities, at levels of 5.38% to 5.41%, 5.42%, 5.75%, 6.20% and 6.22% respectively.

In the secondary bill market, 14/01/2022 bill maturity traded at a low of 4.91% while April and June 2021 maturities changed hands at levels of 4.58% to 4.67% and 4.72% respectively.

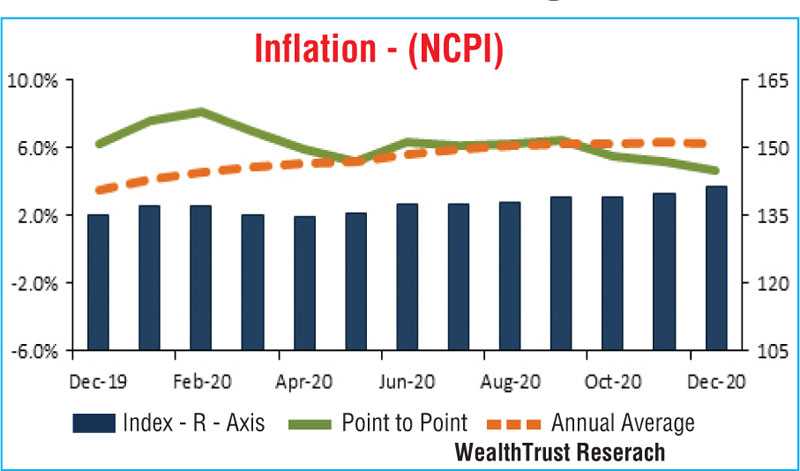

The National Consumer Price Index (NCPI) for the month of December decreased for a third consecutive month to 4.6% on its point to point, when compared against its previous month’s figure of 5.2%. The annual average index too decreased to 6.2% from 6.3%.

The total secondary market Treasury bond/bill transacted volumes for 20 January was Rs. 19.81 billion.

In the money market, weighted average rates on overnight call money and repo’s remained mostly unchanged to average 4.54% and 4.55% respectively with surplus liquidity decreasing further to Rs. 160.12 billion.

Rupee loses marginally

In the Forex market, the USD/LKR rate on the more active spot next contracts was seen depreciating marginally to close the day at Rs. 197.00/199.00 against its previous day’s closing level of Rs. 196.00/198.00 on the back of buying interest.

The more demanded spot contracts traded at level of Rs. 196.00.

The total USD/LKR traded volume for 20 January was $ 57.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)