Monday Mar 09, 2026

Monday Mar 09, 2026

Tuesday, 28 April 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth

Trust Securities

The secondary market yields closed the day broadly steady yesterday, subsequent to edging up during the morning hours of trading.

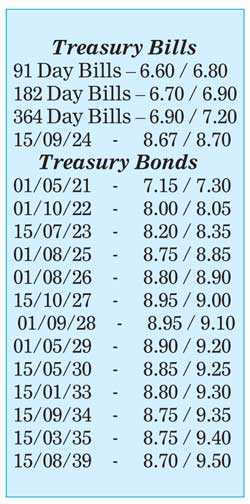

Today’s Treasury bill auction will have on offer a total amount of Rs.30 billion, consisting of Rs.7.5 billion each of the 91 and 182 day maturities and a further Rs.15 billion of the 364 day maturity. At last week’s auction, the weighted average yields of the 91 and 364 day maturities remained steady at 6.75% and 7.00% respectively with the weighted average yield of the 182 day bill increasing by 01 basis point to 6.80%. In the secondary bond market, yields of the liquid maturities consisting of 15.09.24 and 15.10.27 were seen increasing to intraday highs of 8.80% and 9.10% respectively, with buying interest at these levels curtailing any further upward  movement and settling at lows of 8.70% and 9.00%. Furthermore, the 01.10.22, 2023s (i.e. 01.09.23 and 15.12.23) and 15.06.24 also changed hands at levels of 8.00%, 8.37% to 8.40% and 8.70% to 8.75% respectively.

movement and settling at lows of 8.70% and 9.00%. Furthermore, the 01.10.22, 2023s (i.e. 01.09.23 and 15.12.23) and 15.06.24 also changed hands at levels of 8.00%, 8.37% to 8.40% and 8.70% to 8.75% respectively.

In money markets, the weighted average yield of overnight call money and repo stood at 6.42% and 6.59% respectively with the net liquidity surplus in the system increasing further to Rs.151.11 billion. The Domestic Operations Department (DOD) of the Central Bank of Sri Lanka refrained from conducting any auctions yesterday.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded at Rs.192.75 yesterday.

The total USD/LKR traded volume for 24 April was $ 54.05 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)

Given below are the closing, secondary market yields of the most frequently traded T – bills and bonds,