Saturday Feb 07, 2026

Saturday Feb 07, 2026

Friday, 11 December 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary market bond yields were seen closing the day broadly steady yesterday with activity moderating ahead of today’s Treasury bond auctions.

The secondary market bond yields were seen closing the day broadly steady yesterday with activity moderating ahead of today’s Treasury bond auctions.

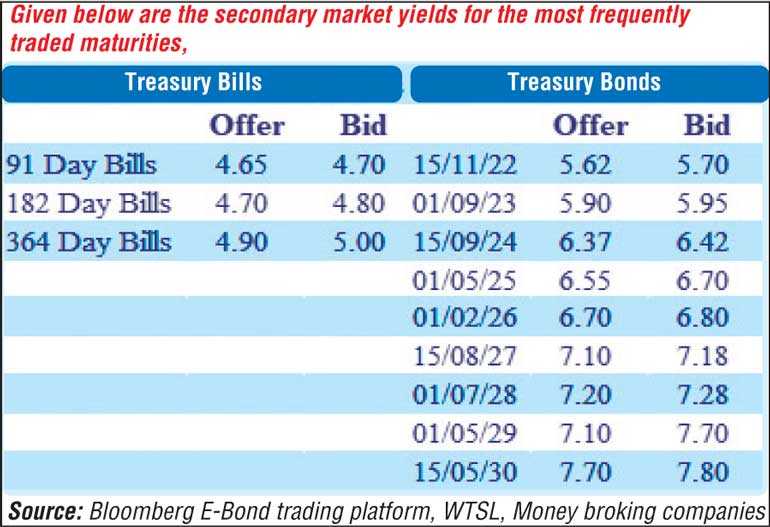

Yields on the 2024 maturities of 15.06.24 and 15.12.24 were seen declining marginally to intraday lows of 6.38% and 6.45% respectively, while 15.12.22, 15.01.23 and 01.07.28 changed hands at levels of 5.70%, 5.75% and 7.25% respectively.

Today’s auction will see in total an amount of Rs. 100 billion on offer in lieu of a Rs. 83.59 billion maturity due on 15 December, which will consist of Rs. 40 billion each of 01.10.2023 and 01.03.2026 and a further Rs. 20 billion of 01.01.2032. Stipulated cut-off rates were published as 6.01%, 6.80% and 7.85% respectively. The weighted average yields at the bond auctions conducted on 12 November for the maturities of 01.12.24 and 15.08.27 were recorded at 6.32% and 7.01% respectively.

The total secondary market Treasury bond/bill transacted volumes for 9 December was Rs. 19.23 billion.

In the money market, the overnight surplus liquidity and weighted average rates on overnight call money and repo was registered at Rs. 242.91 billion, 4.53% and 4.55% respectively.

Rupee loses marginally

In the Forex market, the USD/LKR rate on the spot contract was seen closing the day marginally lower at Rs. 185.80/10, against its previous day’s closing level of Rs. 185.60/90, subsequent to trading within the range of Rs. 185.90 to Rs. 186.05.

The total USD/LKR traded volume for 9 December was $ 22.65 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)