Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 10 December 2021 03:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yields edged up marginally yesterday in comparison to its previous day’s closings, pausing a continuous dip in yields since 29 November.

The secondary bond market yields edged up marginally yesterday in comparison to its previous day’s closings, pausing a continuous dip in yields since 29 November.

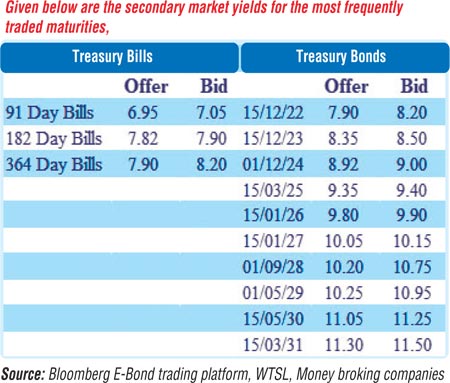

Yields on the liquid maturities of 01.12.24 and 15.01.26 were seen increasing to intraday highs of 8.99% and 9.90% respectively against its previous day’s closing levels of 8.90/95 and 9.70/80. Furthermore, 15.03.25 maturity was also traded within the range of 9.35% to 9.36% while two-way quotes on the rest of maturities were seen increasing and widening during the day.

In secondary bills, February and March 2022 bill maturities changed hands at 7.00% to 7.05%.

The total secondary market Treasury bond/bill transacted volume for 8 December was Rs. 42.9 billion. In money markets, the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka conducted auctions for outright sales of Treasury bills totalling Rs. 15 billion for periods ranging from 84 days to 98 days. A total of Rs. 7.25 billion was accepted in total at weighted average rates ranging from 7.00% to 7.02%. Furthermore, it drained out an amount of Rs. 39.30 billion by way of an overnight Repo auction at a weighted average rate of 5.99% while an amount of Rs. 79.14 billion was deposited at the Central Bank’s SDFR (Standard Deposit Facility Rate) of 5%.

The net overnight liquidity shortfall increased to Rs. 248.86 billion yesterday as an amount of Rs. 367.30 billion was withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate) of 6%.

USD/LKR

In the Forex market, the overall market remained inactive yesterday.

The total USD/LKR traded volume for 8 December was $ 53.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)