Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 5 November 2018 00:00 - - {{hitsCtrl.values.hits}}

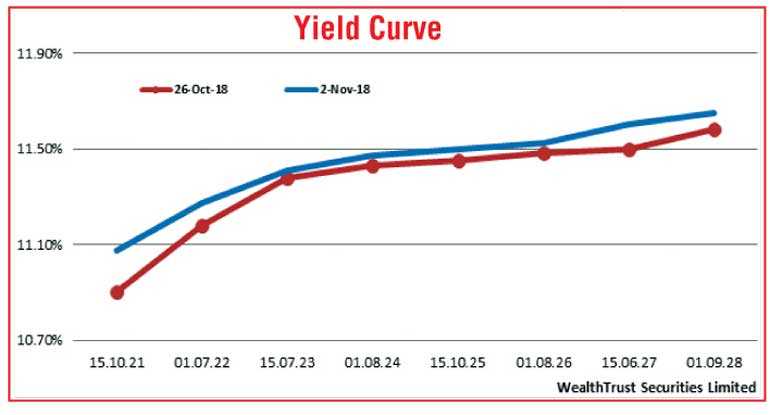

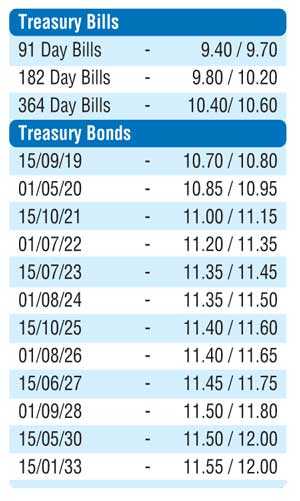

The secondary bond market yields were seen see sawing during the week ending 2 November, increasing during the start of the week, dipping mid-week and increasing towards the end of the week once again.

Activity mainly centred on the short end of the yield curve as yields on the liquid maturities of 15.09.19, 01.05.21, 15.12.21 and 15.07.23 were seen increasing during the start of the week to weekly highs of 10.95%, 11.44%, 11.68% and 11.75%, respectively, against their previous weeks closing levels of 10.20/25, 10.85/00, 10.90/00 and 11.35/40 on the back of foreign selling interest and prevailing uncertainties.

Nevertheless renewed buying interest at these levels subsequent to the outcome of the weekly Treasury bill auction at where all bids received were rejected saw yields decreasing once again with the maturities of 15.09.19, 01.05.20, 15.07.23 and 01.08.24 hitting lows of 10.65%, 10.80%, 11.30% and 11.40%, respectively. The outcome on Inflation further supported the downward trend as its point to point and annual average dipped to 3.1% and 5.0%, respectively, against its previous month of 4.3% and 5.4%.

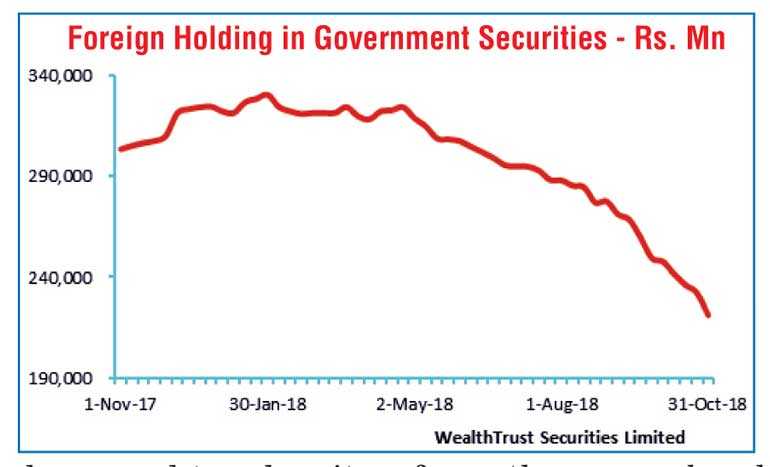

However, persistent foreign selling saw yields increase once again at the end of the week with the 15.03.23 and 15.07.23 maturities edging up to 11.50% and 11.40%, respectively. The outflow of dollars from the rupee bond market continued for a ninth consecutive week recording Rs. 10.97 billion for the week ending 31 October.

The daily secondary market Treasury bond/bill transacted volume for the first three days of the week averaged Rs. 11.73 billion.

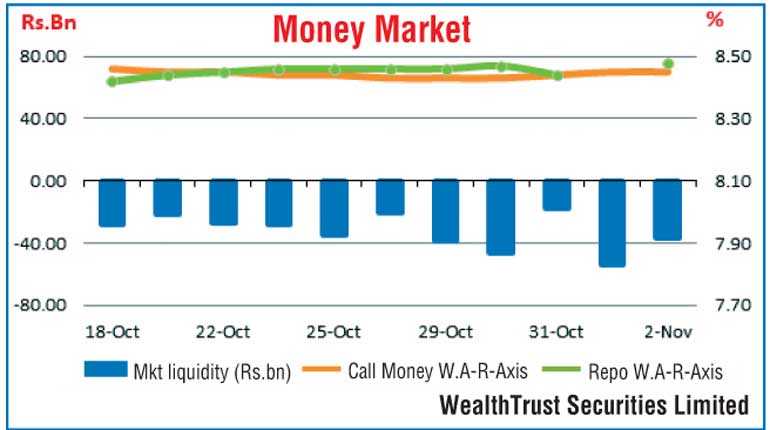

In money markets, the overnight call money and repo rates averaged at 8.44% and 8.46%, respectively, for the week as the OMO (Open Market Operation) Department of the Central Bank injected liquidity throughout the week on an overnight and term basis for periods of six to 14 days at weighted averages ranging from 8.43% to 8.48% and 8.45% to 8.49%, respectively. The average net liquidity shortage in the system increased to Rs. 38.60 billion against its previous weeks of Rs. 27.76 billion.

Rupee loses further

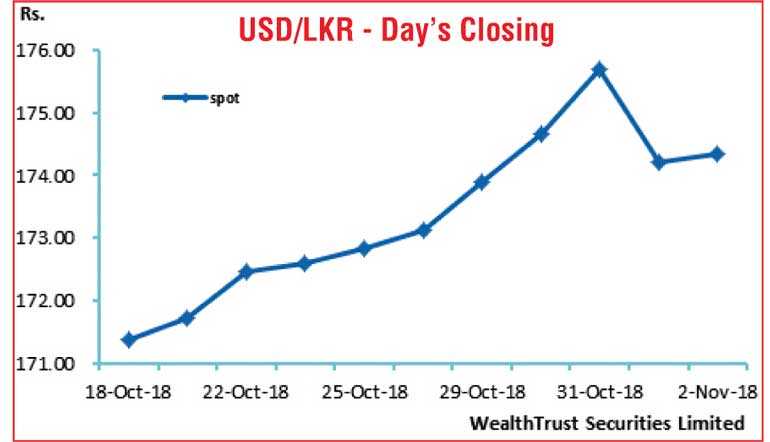

In the Forex market, the USD/LKR rate on the spot contracts depreciated further during the first half of the week to hit a fresh low of Rs. 175.75 on the back of foreign selling in rupee bonds and importer demand before bouncing back to Rs. 174.20/50 on the back of selling interest by banks. It closed the previous week at Rs. 173.05/20.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 77.75 million. Some of the forward dollar rates that prevailed in the market were 1 month – 175.20/50, 3 months – 177.10/50, and 6 months – 180.10/50