Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 15 November 2017 00:13 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yields increased further yesterday on the back of average volumes changing hands  with selling interest mainly on the liquid maturity of 01.08.26 resulting in its yield hitting an intraday high of 10.25% against its previous day’s closing levels of 10.10/20.

with selling interest mainly on the liquid maturity of 01.08.26 resulting in its yield hitting an intraday high of 10.25% against its previous day’s closing levels of 10.10/20.

Furthermore, maturities consisting of 01.05.19, 15.09.19, 01.08.21 and 15.05.30 were seen changing hands at levels of 9.70%, 9.68%, 10.00% and 10.60% respectively.

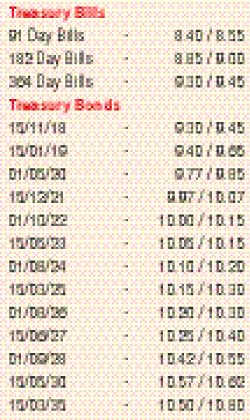

Today’s Treasury bill auction will have on offer an total amount of Rs. 21 billion, consisting of Rs. 4 billion of the 91 day, Rs. 7 billion of the 182 day and Rs. 10 billion of the 364 day maturities. At last week’s auction, the weighted averages continued to decrease, with the 91, 182 and 364 day maturities decreasing by eight basis points each and four basis points respectively to 8.67%, 9.02% and 9.44%. The total secondary market Treasury bond/bill transacted volumes for 13 November 2017 was Rs. 2.23 billion. In money markets, the overnight call money and repo rates remained mostly unchanged to average 8.14% and 7.73% respectively as the OMO Department of the Central Bank of Sri Lanka drained out an amount of Rs. 15.67 billion at a weighted average of 7.25%, by way of an overnight repo auction. The net surplus in the system stood at Rs. 27.49 billion.

Rupee dips marginally

The USD/LKR rate on spot contracts dipped marginally yesterday to close the day at levels of Rs. 153.65/70 against its previous day’s closing level of Rs. 153.57/62 on the back of importer demand.

The total USD/LKR traded volume for 13 November 2017 was $ 55.45 million. Some of the forward USD/LKR rates that prevailed in the market were one month - 154.55/65; three months - 156.40/50 and six months - 158.85/95.

Reuters: The rupee closed slightly weaker on Tuesday due to late importer demand for the US currency as investors awaited clarity on budget policies announced last week, dealers said.

Reuters: The rupee closed slightly weaker on Tuesday due to late importer demand for the US currency as investors awaited clarity on budget policies announced last week, dealers said.

The Government imposed new taxes on motor vehicles, telecoms, banks and liquor in a bid to boost revenues, in its 2018 budget outlined last week, as the budget deficit for the current year slipped to 5.2% of GDP.

The spot rupee closed at 153.63/65 per dollar, little weaker compared with Monday’s close of 153.57/65.

“There was importer dollar demand in the latter part of the day. A state bank also tried to buy dollars for fuel imports. There was not much happening today and still banks are waiting for clarity on budget policies,” a currency dealer said requesting anonymity.

Finance Minister Mangala Samaraweera announced on Wednesday tax concessions worth a monthly Rs. 1.5 billion. The rupee has slipped 2.6% so far this year.

Foreign investors had invested a net Rs. 19.1 billion ($ 124.4 million) in equities this year as of Tuesday’s close, and Rs. 44.3 billion in government securities as of 8 November, official data showed.