Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 24 February 2023 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Activity in the secondary bond market remained rather dull yesterday while two-way quotes increased and widened as most market participants opted to remain on the sidelines.

Activity in the secondary bond market remained rather dull yesterday while two-way quotes increased and widened as most market participants opted to remain on the sidelines.

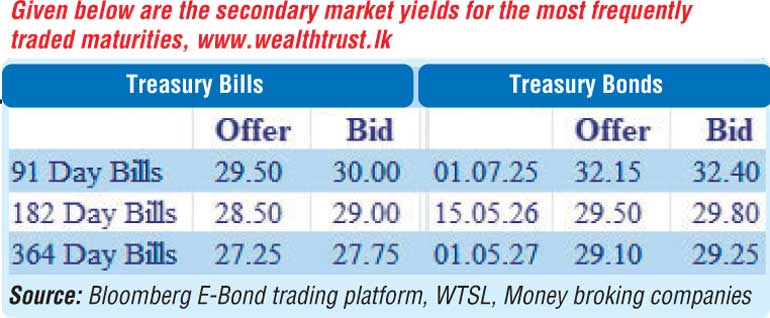

Limited number of trades were witnessed on the 01.05.27 maturity at levels of 29.15% to 29.18% against its previous day’s closing level of 28.95/10. In secondary bills, March, April, May, June and August 2023 maturities changed hands at levels of 26.00% to 26.50%, 27.00% to 28.10%, 29.83% to 29.98%, 29.90% to 30.00% and 28.67% to 28.82% respectively.

The total secondary market Treasury bond/bill transacted volume for 22 February was Rs. 43.09 billion.

In money markets, the weighted average rates on overnight call money and REPO stood at 15.47% and 15.50% respectively while an amount of Rs. 134.74 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 15.50%.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts was broadly steady Rs. 361.66 against its previous day’s closing level of Rs. 361.6615.

The total USD/LKR traded volume for 21 February was $ 76.65 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)