Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 7 July 2020 00:30 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

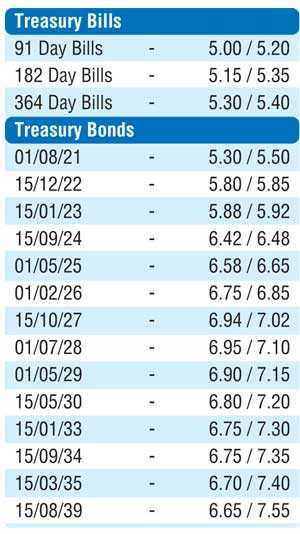

The start of a fresh trading week saw activity in the secondary bond market moderate once again, with limited trades of the 15.01.23 and 01.05.25 maturities changing hands at levels of 5.85% to 5.90% and 6.58% to 6.63% respectively. Furthermore, the 2023’s (i.e. 15.07.23, 01.09.23 & 15.12.23), 01.08.25 and 15.01.27 maturities were traded at levels of 6.07% to 6.15%, 6.66% and 6.95% to 6.97% respectively.

In the secondary bill market, August 2020 and January to July 2021 maturities changed hands at a level of 5.20% to 5.25% and 5.25% to 5.40% respectively.

The total secondary market Treasury bond/bill transacted volume for 3 July was Rs. 9.93 billion.

In money markets, the weighted average rates on overnight call money and repo remained mostly unchanged at 5.51% and 5.55% respectively as the overnight net liquidity surplus in the system stood at Rs. 162.62 billion yesterday.

Rupee closes steady

In Forex markets, the USD/LKR on spot contracts were seen closing the day steady at Rs. 185.80/90 subsequent to appreciating to an intraday high of Rs. 185.75 on the back of spot and forward selling interest by banks.

The total USD/LKR traded volume for 3 July was $ 106.92 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)