Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 4 April 2022 02:34 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The uncertainties in the market due to the rejection of the Treasury bond auctions, continued steep increases at the weekly Treasury bill auctions, galloping inflation along with advancement of the monitory policy announcement date, led to sentiment turning bearish in the secondary bond market.

The uncertainties in the market due to the rejection of the Treasury bond auctions, continued steep increases at the weekly Treasury bill auctions, galloping inflation along with advancement of the monitory policy announcement date, led to sentiment turning bearish in the secondary bond market.

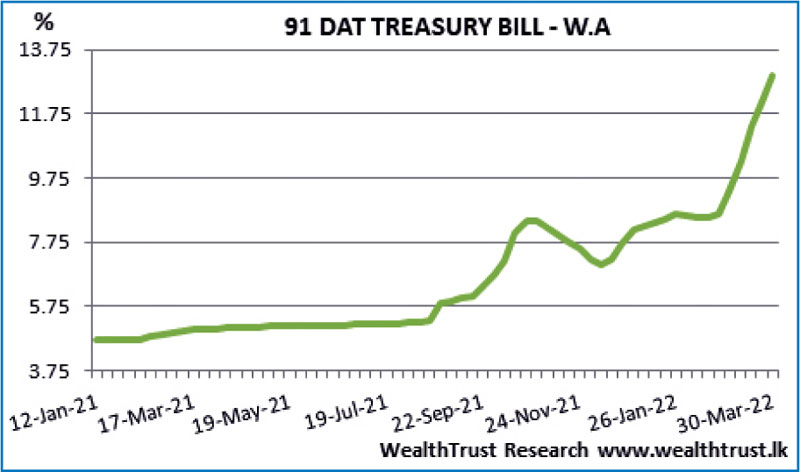

At the primary Treasury bond auctions, all bids received were rejected for the first time since February 2017 while at the primary Treasury bill auction, the weighted average rate on the market favourite 91-day bill soared for a sixth consecutive week.

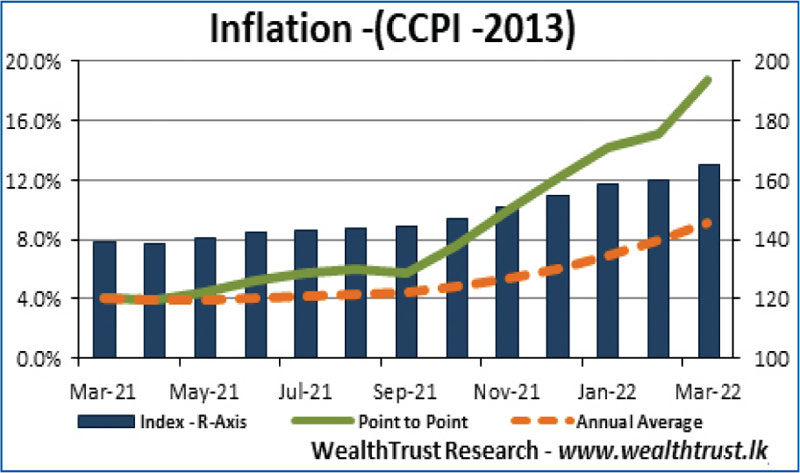

The Colombo Consumer Price Index (CCPI; Base 2013=100) for the month of March increased sharply to a high of 18.7% on its point to point against its previous month’s figure of 15.1%.

Furthermore, the announcement date of the Monetary Policy Review No. 03 of 2022 which was initially scheduled for 7 April was brought forward to Tuesday, 5 April 2022 at 7:30 a.m.

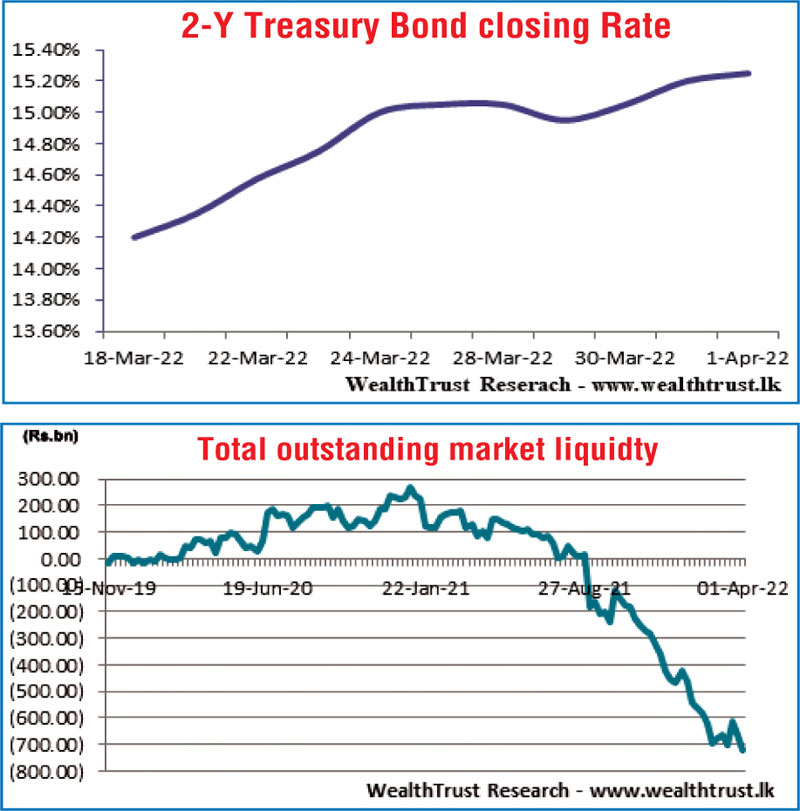

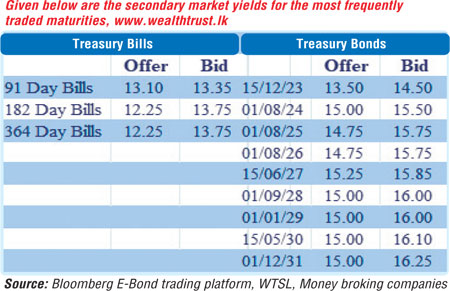

In the secondary bond market, limited trades were witnessed only on the liquid 01.08.24 maturity at levels of 15.40% to 15.43% against its previous weeks closing level of 14.85/25 while in secondary market bills, the latest 91-day bill maturity changed hands at level of 13.00% to 13.25%.

The foreign holding in rupee bonds remained mostly unchanged at Rs. 2.65 billion for the week ending 30 March while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 9.96 billion. In money markets, the total outstanding liquidity deficit increased further to Rs. 718.63 billion by the end of the week against its previous weeks of Rs. 660.65 billion while CBSL’s holding of Government Securities stood at Rs. 1,730.43 billion against its previous weeks of Rs. 1,700.56 billion.

The Domestic Operations Department (DOD) of Central Bank was seen injecting liquidity by way of a seven-day reverse repo auctions at a weighted average rate of 7.50%. The weighted average rates on call money and repo remained mostly unchanged at 7.49% and 7.50% respectively for the week.

Forex market

In forex markets, the USD/LKR spot contracts traded at a level of Rs. 298.97 to Rs. 330.00 during the week while overall activity remained moderated. The daily USD/LKR average traded volume for the four trading days of the week stood at $ 22.67 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)