Friday Mar 06, 2026

Friday Mar 06, 2026

Monday, 5 April 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

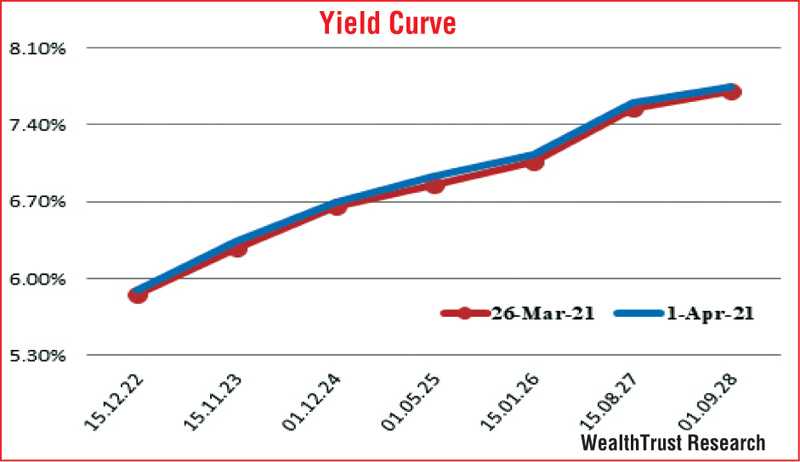

The sluggish sentiment in the secondary bond market saw limited trades taking place across the yield curve within a narrow range during the shortened trading week ending 1 April.

The sluggish sentiment in the secondary bond market saw limited trades taking place across the yield curve within a narrow range during the shortened trading week ending 1 April.

The continued under-subscription at the primary bill and bond auctions along with the drop in liquidity was seen as the reasons behind this sentiment.

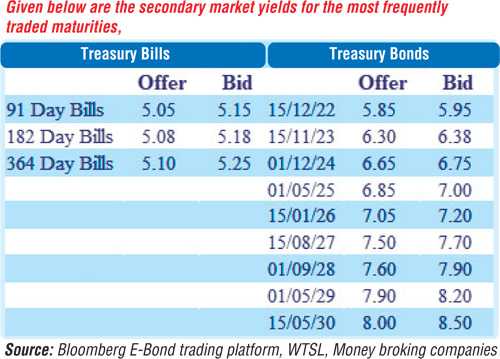

The limited trades were witnessed on the maturities of 2022’s (i.e. 01.10.22 and 15.12.22), 15.01.23, other 2023’s (i.e. 15.05.23, 15.07.23 and 15.11.23), 15.03.24, other 2024’s (i.e. 01.08.24 and 01.12.24) and 15.09.34 at level of 5.85% to 5.88%, 5.95%, 6.25% to 6.35%, 6.50%, 6.60% to 6.65% and 8.35% respectively. In the secondary bill market, April 2021 maturities, May 2021 maturities, June to July 2021 maturities and October to December 2021 maturities traded at levels of 4.70%, 4.85% to 4.88%, 4.90% to 5.05% and 5.08% to 5.09% respectively.

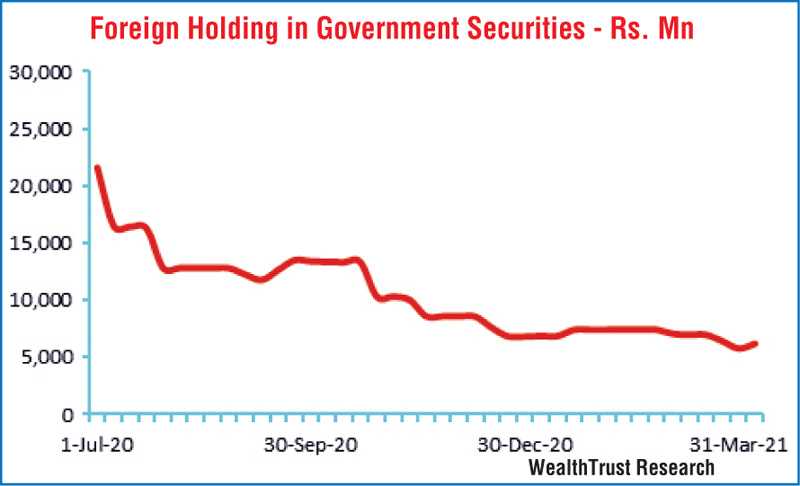

However, on a positive note, the foreign holding in Rupee bonds was seen increasing for the first time in eight weeks to record an inflow of Rs. 416.65 million for the week ending 31 March.

The daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 9.07 billion.

In money markets, the total outstanding market liquidity was seen decreasing during the week to a low of Rs. 86.33 billion against its previous weeks closing of Rs. 127.70 billion while CBSL’s holding of Gov. Security’s increased Rs. 844.02 billion against its previous weeks of Rs. 842.25 billion. The weighted average rates on overnight call money and repo remained mostly unchanged to average 4.62% and 4.64% respectively for the week.

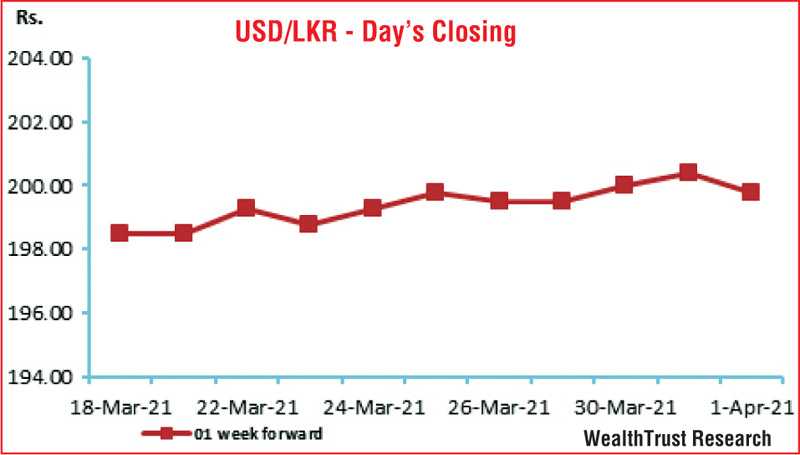

USD/LKR

In Forex markets, the USD/LKR rate on spot contracts was seen trading at levels of Rs. 199.50 to Rs. 199.80 during the week while the more active 01 week forward contracts were seen closing the week at Rs. 199.50/200.00 in comparison to its previous weeks closing level of Rs. 199.25/199.75. The daily USD/LKR average traded volume for the first three days of the week stood at $ 57.37 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)