Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 14 November 2022 00:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The bearish to negative sentiment in the secondary bond market continued during the shortened trading week ending 11 November as activity remained at a standstill.

The bearish to negative sentiment in the secondary bond market continued during the shortened trading week ending 11 November as activity remained at a standstill.

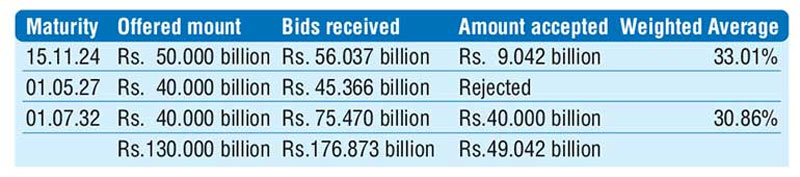

This sentiment was seen affecting the Treasury bond auctions conducted on Friday as the total accepted amount decreased to a low of 37.72% of its total offered amount as only a total amount of Rs. 49.04 billion was successfully taken up across three maturities against a total offered amount of Rs. 130 billion. The weighted average rates on the auctioned maturities of 15.11.2024 and 01.07.2032 were registered at 33.01% and 30.86% respectively while Phase II of the auction was opened for the undersubscribed 15.11.2024 maturity whereas the direct issuance window of 20% will be on offer on the fully subscribed 01.07.2032 maturity until close of business of the day prior to settlement (i.e. 4 p.m. on 14.11.2022). All bids received for the 01.05.2027 maturity was rejected.

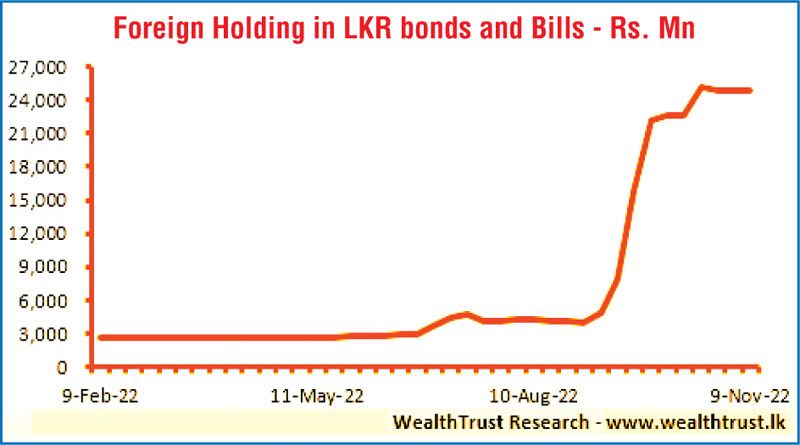

Nevertheless, demand at the weekly Treasury bill auction increased further with the total accepted amount exceeding the total offered amount subsequent to Phase II of the auction. Unsurprisingly, the 91-day bill represented 94.23% of the total accepted amount while its weighted average increased by 4 basis points to 33.14%. The foreign holding in Rupee bonds increased marginally to Rs. 24.87 billion for the week ending 9 November 2022 while the daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 20.23 billion.

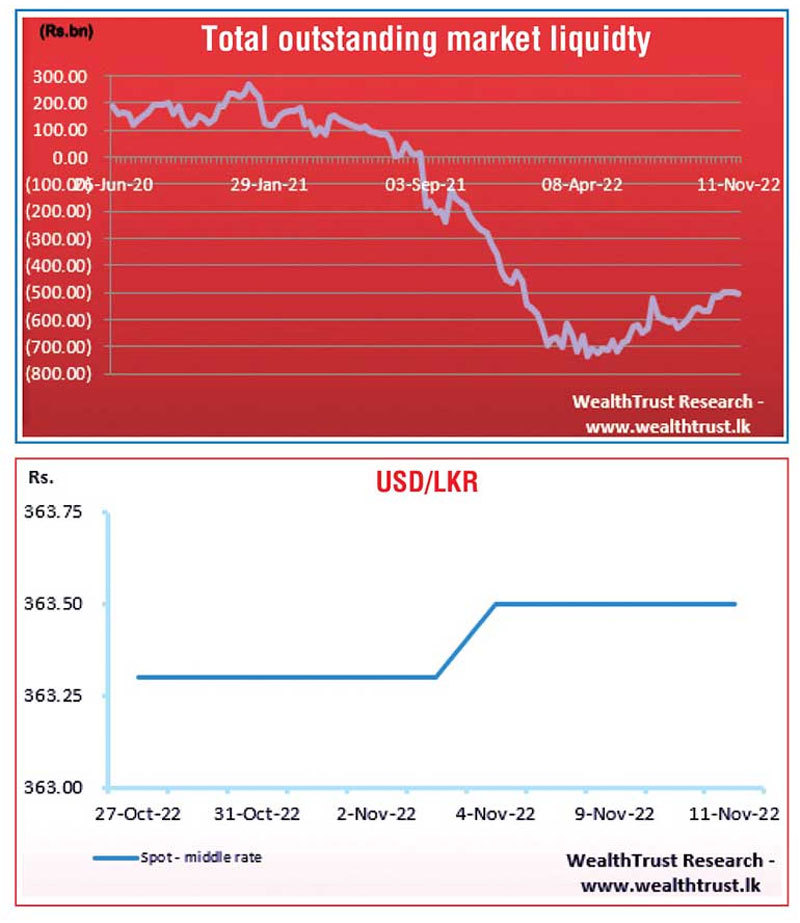

In money markets, the Domestic Operations Department (DOD) of Central Bank injected Rs. 50 billion in total during the week by way of 61 and 90-day Reverse repo auctions at weighted average yields of 28.00% and 30.00% respectively.

The weighted average rates on overnight call money and repo were at 15.50% each for the week while the total outstanding liquidity deficit was registered at Rs. 504.75 billion by the end of the week against its previous weeks of Rs. 499.53 billion. The CBSL’s holding of Government Securities stood at Rs. 2,440.75 billion against its previous week’s of Rs. 2,442.73 billion.

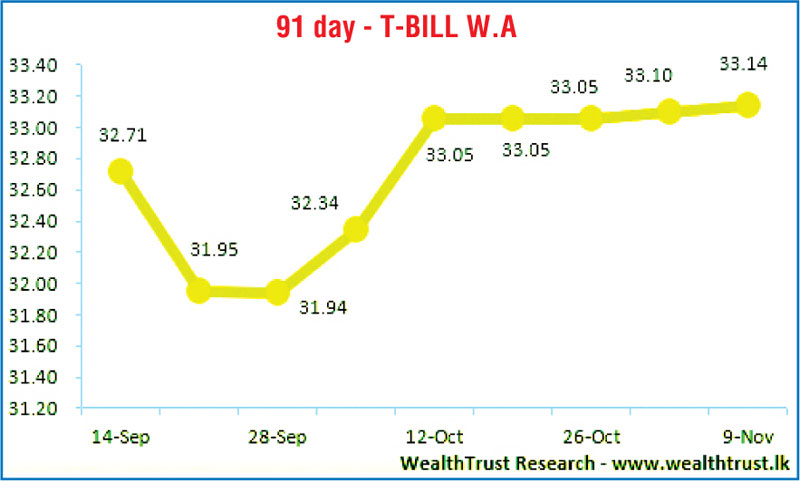

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts remained steady during the week to close the week at Rs. 363.50.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 44.16 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)