Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 30 August 2021 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

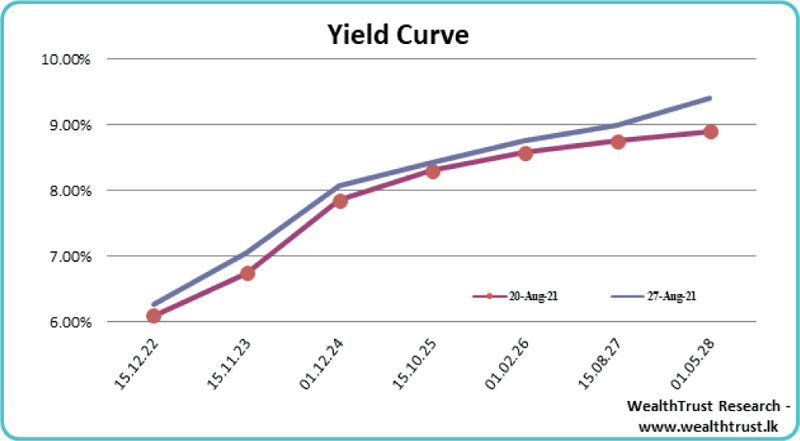

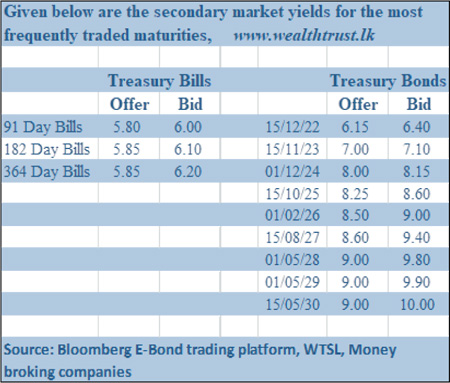

The secondary bond market sentiment closed the week ending 27 August on a bearish note as activity was seen moderating considerably towards the later part of the week. The limited activity witnessed during the week predominantly centred on the 15.11.23 and 2024 (i.e. 15.09.24 and 01.12.24) maturities as its yields were seen hitting highs of 7%, 8.05%, and 8.12%, respectively, against its previous weeks closing level of 6.70/80, 7.50/80, and 7.80/90.

The secondary bond market sentiment closed the week ending 27 August on a bearish note as activity was seen moderating considerably towards the later part of the week. The limited activity witnessed during the week predominantly centred on the 15.11.23 and 2024 (i.e. 15.09.24 and 01.12.24) maturities as its yields were seen hitting highs of 7%, 8.05%, and 8.12%, respectively, against its previous weeks closing level of 6.70/80, 7.50/80, and 7.80/90.

Yesterday’s bond auctions had on offer an amount of Rs. 50 billion in total, consisting of Rs. 30 billion of the 01.09.2023 maturity and Rs. 20 billion of the 15.10.2025 maturity. The maximum yield rate for acceptance for the said maturities was published at 6.75% and 8.55%, respectively. The weighted average yields at the bond auctions conducted on yesterday, prior to monetary policy adjustment were 6.87%, 7.47%, 8.17%, and 8.86% for the maturities of 01.12.24, 01.02.26, 01.05.28 and 15.03.31, respectively. The second phase of the auction was opened for the undersubscribed maturities while a direct issuance window was opened for the subscribed maturities.

The weekly Treasury bill auction conducted during the week, the first after the monetary policy announcement, saw its subscription level increase to 66.05% of its total offered amount while the weighted average rates increased across the board by 54, 56 and 61 basis points, respectively, to 5.87%, 5.90%, and 5.93%.

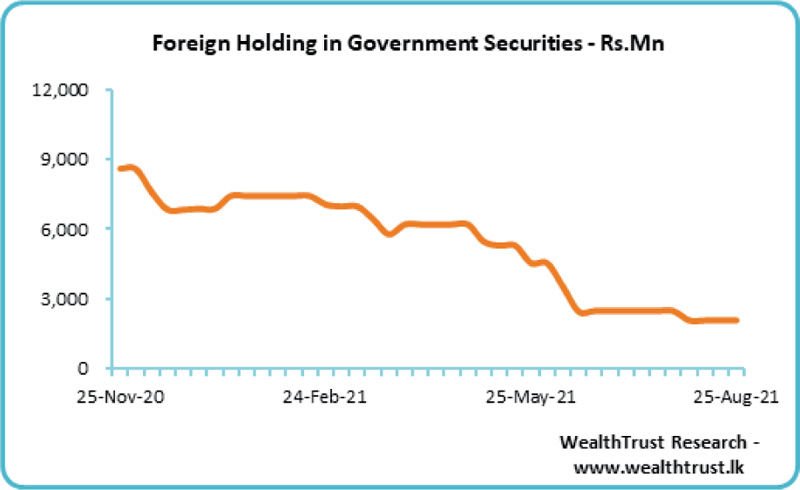

The foreign holding in Rupee bonds remained mostly unchanged at Rs. 2.087 billion for the week ending 25 August while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 8.98 billion.

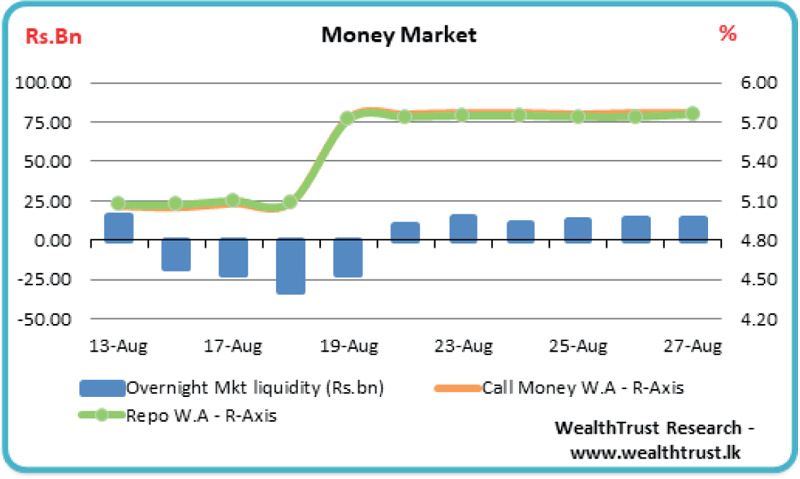

In money markets, the Central Bank Domestic Operations Department (DOD) drained out liquidity during the week on an overnight basis at weighted average yields ranging from 5.71% to 5.74% as the total outstanding liquidity surplus increased to Rs. 13.26 billion by the end of the week from its previous week’s Rs. 9.15 billion. The weighted average yields on overnight call money and repo rates averaged 5.77% and 5.75%, respectively, for the week while the CBSL’s holding of government securities increased further to Rs. 1,215.10 billion from its previous week’s Rs. 1,203.441 billion.

USD/LKR

The Forex market continued to remain inactive during the week. The daily USD/LKR average traded volume for the first four trading days of the week stood $ 12.56 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)