Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 2 October 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond and bill markets remained dull yesterday ahead of today’s weekly Treasury bill auction.

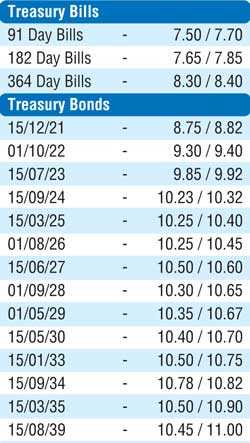

In very limited trades, the 15.06.24 and 15.09.34 bond maturities changed hands at levels of 10.27% and 10.78% respectively while the 19 June 2020 bill maturity changed hands at 8.10%.

At today’s Treasury bill auction, the total offered amount of Rs. 12 billion will consist of Rs. 2.5 billion on the 91-day maturity, Rs. 1 billion on the 182-day maturity and Rs. 8.5 billion on the 364-day maturity. At last week’s auction, the weighted average on the 182-day and 364-day maturities remained steady at 7.75% and 8.41% respectively while the weighted average on the 91-day bill increased by one basis point to 7.62%. The total secondary market Treasury bond and bill transacted volume for 30 September 2019 was Rs. 7.99 billion.

In the money market, the overnight call money and repo rates averaged 7.43% and 7.53% respectively as the overnight net liquidity surplus stood at Rs. 23.85 billion yesterday.

Rupee hits Rs. 182.37

The USD/LKR rate on spot contracts continued to lose ground yesterday to hit a low of Rs. 182.37 and close the day at Rs. 182.30/40 against its previous day’s closing levels of Rs. 182.00/15 on the back of continued buying interest by banks.

The total USD/LKR traded volume for 30 September 2019 was $ 69.00 million

Some of the forward USD/LKR rates that prevailed in the market were one month - 182.80/00; three months - 183.85/05 and six months - 185.55/70.