Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 4 September 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The dull sentiment in the secondary bond market continued yesterday as most market participants  continued to be on the sidelines ahead of today’s weekly Treasury bill auctions. Limited trades were witnessed on the 15.07.23 and 15.06.24 maturities at levels of 9.85% and 10.00% respectively.

continued to be on the sidelines ahead of today’s weekly Treasury bill auctions. Limited trades were witnessed on the 15.07.23 and 15.06.24 maturities at levels of 9.85% and 10.00% respectively.

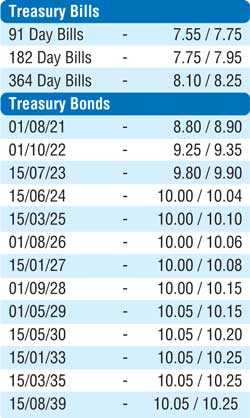

At the auction, a total amount of Rs. 15 billion will be on offer consisting of Rs. 1 billion each on the 91 day maturity and the 182 day maturity and a further Rs. 13 billion on the 364 day maturity. At last week’s auction, the weighted averages decreased across the board by 21, 19 and 9 basis points respectively to 7.63%, 7.70% and 8.22% on the 91 day, 182 day and 364 day maturities.

The total secondary market Treasury bond/bill transacted volumes for 2 September was Rs.8.65 billion.

In money markets, overnight call money and repo rates averaged 7.52% and 7.53% respectively yesterday as the Open Market Operations (OMO) Department of the Central Bank injected amounts of Rs. 15 billion and Rs. 10 billion by way of overnight and seven-day reverse repo auctions at weighted averages of 7.51% and 7.55% respectively.

In addition, an amount of Rs. 10 billion was injected by way of 14 day reverse repo auction at a weighted average rate of 7.58% valued today as the overnight net liquidity shortfall in the system increased to Rs. 22.49 billion yesterday.

Rupee dips further

The Interbank USD/LKR rate on spot contracts depreciated further to close the day at Rs. 180.35/50 against its previous day’s closing levels of Rs. 179.75/00 on the back of buying interest by banks and importer demand.

The total USD/LKR traded volume for 2 September was $ 81 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 180.90/10; three months – 181.90/20; six months – 183.50/80.