Thursday Feb 26, 2026

Thursday Feb 26, 2026

Monday, 29 June 2020 00:41 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

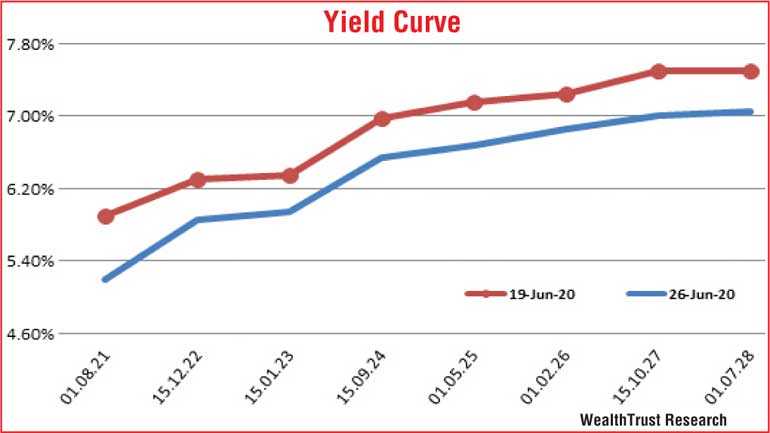

The secondary bond market opened the week on a bullish note, which continued throughout the week ending 26 June, as yields were seen tumbling to over five-year lows to levels last seen in September 2014.

Buying interest across the yield curve resulted in rates of the liquid maturities of 15.12.12, 15.01.23, 15.09.24, 01.05.25, 01.02.26 and 15.10.27 dipping to lows of 5.70%, 5.80%, 6.32%, 6.55%, 6.75% and 6.90%, respectively, against its previous weeks closing levels of 6.25/35, 6.30/40, 6.95/00, 7.12/18, 7.20/30 and 7.47/52, reflecting a parallel shift downwards of the overall yield curve.

Furthermore, maturities such as the 2021’s (i.e. 01.03.21, 01.05.21, 15.10.21 and 15.12.21), 01.10.22, 2023’s (i.e. 15.03.23, 15.05.23, 15.07.23, 01.09.23 and 15.12.23), 2024’s (i.e. 01.01.24, 15.03.24, 15.06.24 and 01.08.24), 2025’s (i.e. 15.03.25 and 01.08.25) and 2026’s (i.e. 01.06.26 and 01.08.26) were actively traded within the range of 5.40% to 6.10%, 6.02% to 6.27%, 6 % to 6.55%, 6.40% to 7%, 6.60% to 7.10% and 7.14% to 7.32% . However, profit taking at these levels curtailed any further downward movement with yields closing marginally higher.

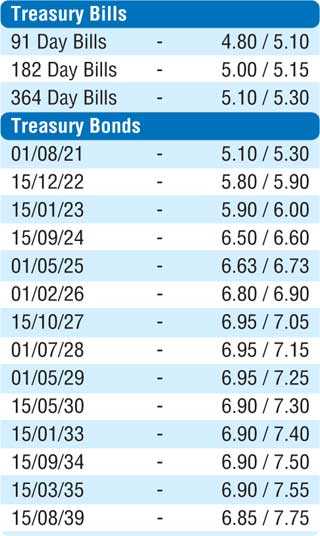

This momentum was even witnessed at the weekly Treasury bill auction, where the weighted average yields of the 91-, 182- and 364-day maturities decreased across the board by 80, 77 and 96 basis points, to all-time lows of 5.50%, 5.53% and 5.66%.

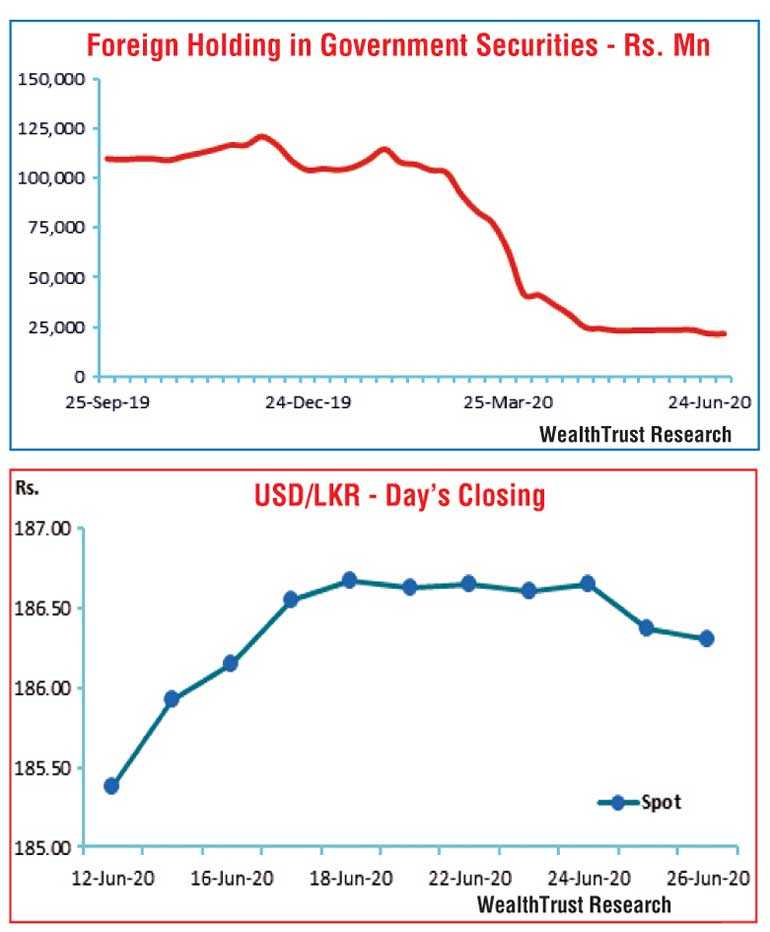

However, an outflow of Rs. 3.39 million was witnessed in the foreign holding of rupee bonds, recording a second week of outflows.

Today’s Treasury bond auctions will see an total amount of Rs. 60 billion on offer, consisting of Rs. 35 billion on a two-year-and-five-month maturity of 15.12.2022 and Rs. 25 billion on a seven-year and one-month maturity of 15.08.2027. The weighted average yields at the auctions conducted on 11 June for the maturities of 15.12.2022 and 01.02.2026 were recorded at 7.75% and 8.59%, respectively.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged Rs. 25.65 billion.

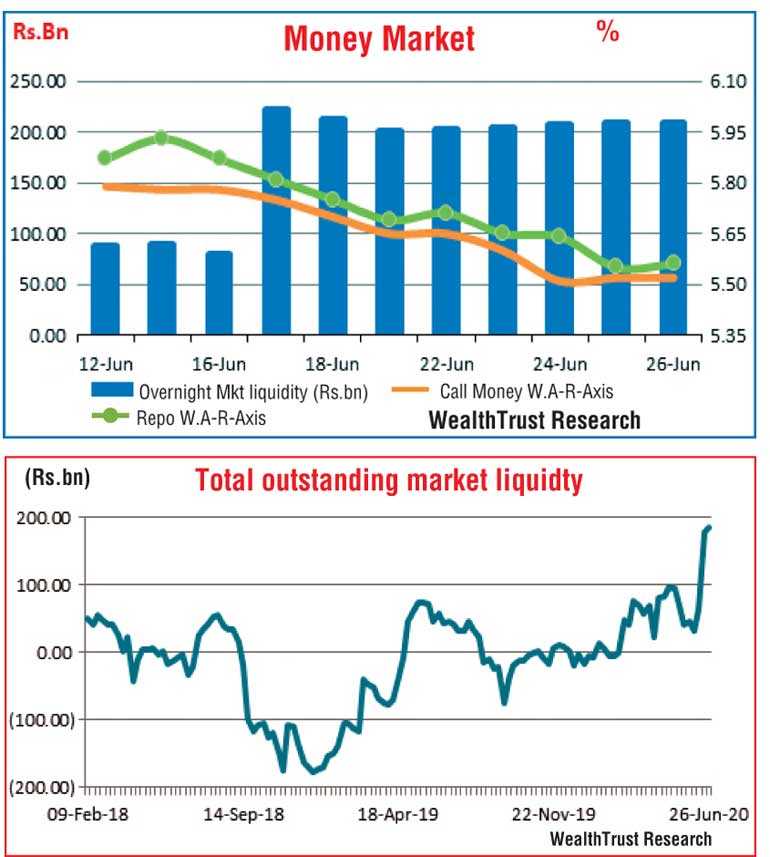

In money markets, the Central Bank Domestic Operations Department (DOD) refrained from conducting any auctions during the week despite the overall market liquidity increasing to Rs. 185.35 billion. The weighted average yield on overnight Call money and Repos were 5.56% and 5.62%, respectively, for the week.

Rupee appreciates during the week

In forex markets, the USD/LKR on spot contracts was seen closing the week stronger than the previous week at Rs. 186.25/35 subsequent to trading within the range of Rs. 186.02 to 186.72.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 83.49 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)