Friday Feb 20, 2026

Friday Feb 20, 2026

Friday, 10 August 2018 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

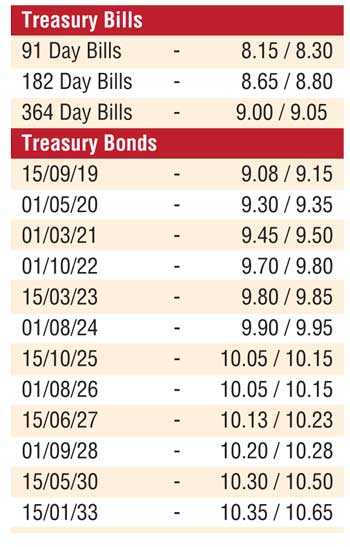

The secondary bond market remained active yesterday with the liquid maturities of 01.07.19, 01.03.21, 15.03.23 and 01.08.24 trading within the range of 9.02% to 9.05%, 9.47% to 9.50%, 9.77% to 9.80%, and 9.85% to 9.92%, respectively. Furthermore, activity consisting of the 01.05.19, 01.05.20, 15.12.21, 01.08.26 and 01.09.28 maturities was also witnessed at levels of 9.00% to 9.10%, 9.30% to 9.35%, 9.62%, 10.05% to 10.08%, and 10.15% to 10.20%. In the secondary bill market, January and August 2019 maturities were traded at levels of 8.60% and 9.05%, respectively.

The total secondary market Treasury bond/bill transacted volumes for 8 August was Rs. 17.90 billion.

In money markets, the net liquidity surplus remained high at Rs. 54.17 billion with overnight call money and repo rates reducing further to average 8.18% and 8.11%, respectively.

Rupee losses further

The USD/LKR rate on spot contracts were seen losing further yesterday to hit lows of Rs. 160.05 before closing marginally higher at Rs. 159.98/04 against its previous day’s closing levels of Rs. 159.92/00 on the back of continued importer demand.

The total USD/LKR traded volume for 9 August was $ 92.68 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 160.80/90; 3 Months - 162.40/60 and 6 Months - 164.70/90.