Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 9 November 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

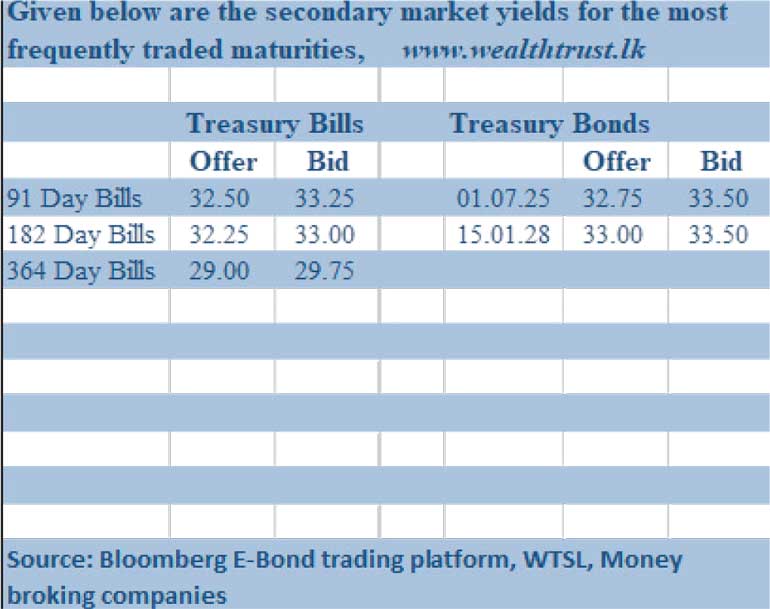

The secondary bond and bill markets were at a standstill at the start of a fresh trading week yesterday ahead of today’s Treasury bill auctions.

The secondary bond and bill markets were at a standstill at the start of a fresh trading week yesterday ahead of today’s Treasury bill auctions.

The Treasury bill auction will see a total volume of Rs. 85 billion on offer, a decrease of Rs. 5 billion over its previous week’s total offered volume. This will consist of Rs. 35 billion on the 91-day maturity, Rs. 30 billion on the 182-day maturity and a further Rs. 20 billion on the 364-day maturity.

At last week’s auction, the weighted average rate on the 91-day maturity increased by 05 basis points to 33.10% while on the 364-day it decreased by 03 basis points to 29.57%. The weighted average rate on the 182-day maturity remained steady at 32.53%. A total amount of Rs. 88.65 billion was accepted at the auction while a further amount of Rs. 2.69 billion was raised at its phase II.

In secondary bills, a 02 December 2022 maturity changed hands at a level of 30.25%.

The total secondary market Treasury bond/bill transacted volume for 04 November 2022 was Rs. 1.46 billion.

In money markets, the weighted average rate on overnight Call money stood at 15.50% yesterday. An amount of Rs. 646.74 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 15.50%. The net liquidity deficit stood at Rs. 316.77 billion as an amount of Rs. 329.97 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 14.50%.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts remained steady at Rs. 363.50 yesterday.

The total USD/LKR traded volume for 04 November was $ 20.28 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)