Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 30 September 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The bond market witnessed an uninspiring week ending 27 September as activity moderated considerably with most market participants staying on the side-lines. The limited amount of activity was mainly seen on 25 September, due to the weekly Treasury bill auction and the outright purchases of Treasury bonds by the Central Bank OMO (Open Market Operations) Department.

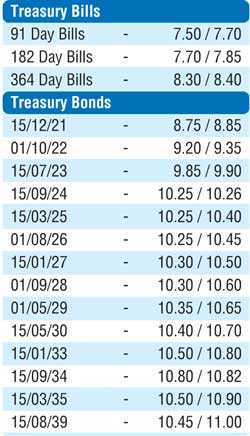

At the weekly Treasury bill auction, the weighted average on the benchmark 364-day bill was seen holding steady at 8.41%, following three consecutive weeks of increases. At the outright purchases of Treasury bonds by the OMO Department, a total amount of Rs. 8.40 billion was injected for durations of one year and seven months to two years and two months (01.05.21, 01.08.21, and 15.12.21) at weighted averages within the range of 8.60% to 8.77%.

In the secondary bond market, activity was witnessed mainly on the long end of the yield curve, with the yield on the 15-year maturity of 15.09.34 dipping to a weekly low of 10.82% against its weeks high of 10.92%. In addition, the two 2024’s (15.06.24 & 15.09.24) were seen changing hands from weekly highs of 10.25% and 10.30%, respectively, to lows of 10.20% and 10.25%.

The foreign holding in rupee bonds dipped for a sixth consecutive week, recording a marginal outflow of Rs. 0.44 billion for the week ending 25 September.

The daily secondary market Treasury bond/bills transacted volume for the first four days of the week averaged Rs. 6.53 billion.

The overall money market liquidity was seen improving further during the week to record a net deficit of Rs. 19.91 billion against its previous week’s net deficit of Rs. 39.23 billion. The OMO Department was seen draining out and injecting liquidity on two separate occasions during the week by way of an overnight repo auction and a 14-day reverse repo auction. The overnight repo auction drained an amount of Rs. 12 billion at a weighted average of 7.38% while an amount of Rs. 20 billion was injected at a weighted average of 7.65%. The overnight net liquidity increased during the week, from Rs. 12.90 billion at the start of the week to Rs. 17.99 billion by the end of the week. The overnight call money and repo rates averaged 7.41% and 7.45% respectively for the week.

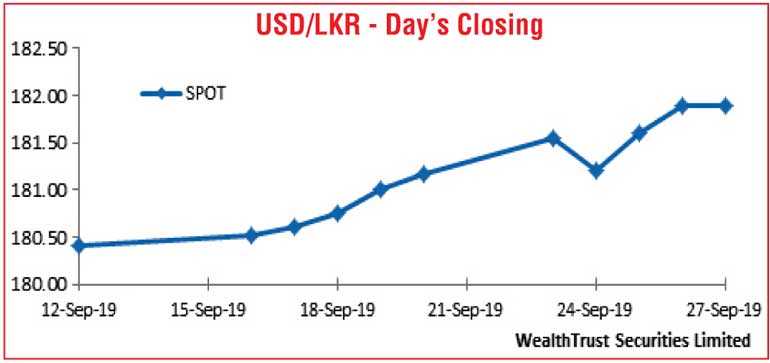

Rupee continues to dip for second consecutive week

In the Forex market, the USD/LKR rate on the spot contracts closed the week lower at Rs. 181.85/95 against its previous weeks closing of Rs.180.35/45 on the back of continued buying interest by banks and importer demand.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 100.28 million.

Some of the forward dollar rates that prevailed in the market were 1 month – 182.35/50; 3 months – 183.35/55, and 6 months – 185.10/40.