Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 24 June 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The downward momentum in secondary market bond yields which commenced during the early part of the week ending 21 June continued throughout the week, with the sentiment ending the week on a bullish note.

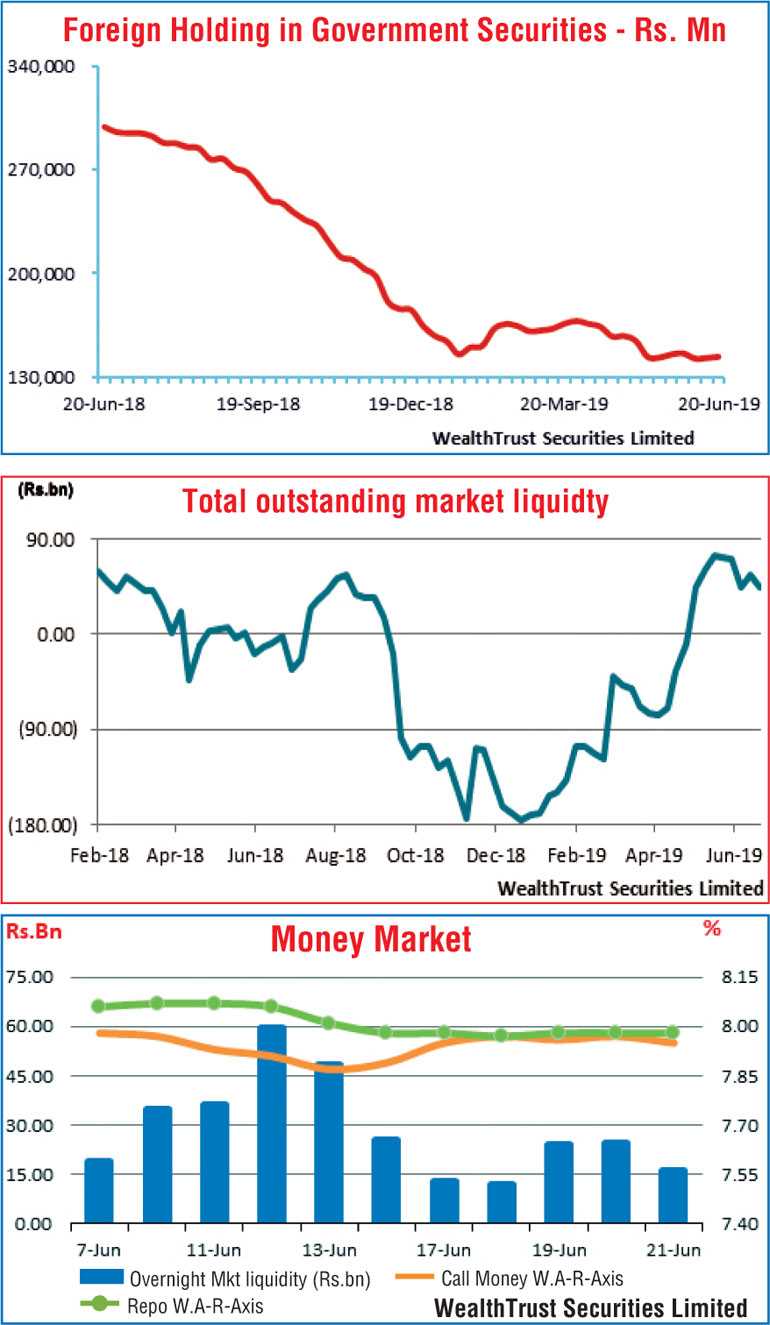

Renewed foreign and local buying interest was seen as the driving force behind the decline in yields which was supported by the outcome of the weekly Treasury bill auction at where weighted averages declined after a lapse of three weeks.

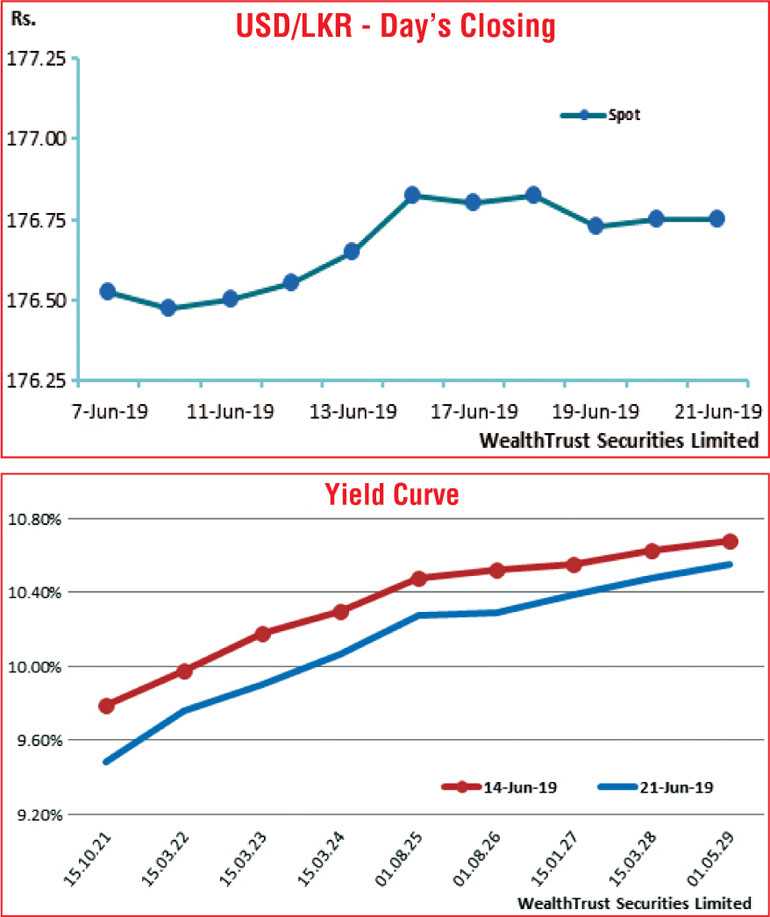

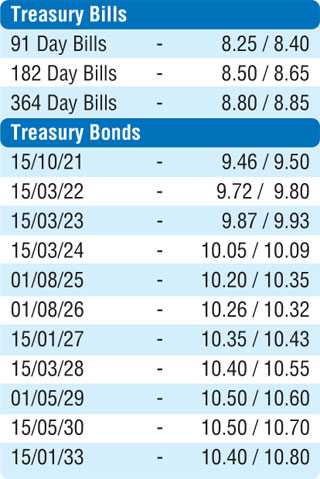

The liquid maturities of two 2021’s (i.e. 15.10.21 & 15.12.21), 15.03.22, two 2023’s (i.e. 15.03.23 & 15.07.23), 15.03.24, 01.08.26 and 15.01.27 saw its yields decreasing to weekly lows of 9.45%, 9.53%, 9.80%, 9.90%, 10.00%, 9.95%, 10.30% and 10.37% respectively against its previous weeks closing levels of 9.77/80, 9.77/82, 9.95/00, 10.15/20, 10.20/30, 10.25/35, 10.48/55 and 10.52/58, reflecting a parallel shift downwards of the overall yield curve for the first time in three weeks. In addition, the 15.06.27 maturity was seen decreasing to low of 10.51% as well.

The foreign holding in rupee bonds was seen increasing for a second consecutive week recording at inflow of Rs. 880 million for the week ending 19 June. Meanwhile the National Consumer Price Index (NCPI) was seen decreasing to 3.5% for the month of June against its previous month of 3.6% on its point to point while its annualised average increased to 2.0%.

The daily secondary market Treasury bond/bills transacted volume for the first four days of the week averaged Rs. 9.84 billion.

In money markets, the overnight surplus liquidity witnessed some volatility during week as it was seen fluctuating from a low of Rs. 12.22 billion to a high of Rs. 24.69 billion. The total money market liquidity stood at Rs. 43.64 billion with the OMO Department of the Central Bank of Sri Lanka mopping up liquidity by way of overnight, 05 day to 8 day term repo auctions at weighted averages ranging from 7.75% to 7.90%. The overnight call money and repo rates averaged at 7.96% and 7.98% respectively for the week.

Rupee closes stronger

In the Forex market, the USD/LKR rate on the spot contracts were seen closing the week stronger at Rs. 176.70/80 in comparison to the previous weeks closing levels of Rs. 176.75/90, subsequent to trading within the range of Rs. 176.60 to Rs. 177.00 during the week.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 91.15 million.

Some of the forward dollar rates that prevailed in the market were 1 month - 177.40/60; 3 months - 178.90/20 and 6 months - 181.10/40.