Tuesday Mar 10, 2026

Tuesday Mar 10, 2026

Wednesday, 24 June 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yields continued to be volatile yesterday as yields on the liquid maturities of 15.12.22, 15.01.23, 15.09.24, 01.05.25, 01.02.26 and 15.10.27 hit intraday lows of 6.00%, 6.12%,  6.77%, 6.94%, 7.05% and 7.17% respectively during morning hours of trading against its previous day’s closing levels of 6.19/21, 6.25/30, 6.95/00, 7.12/17, 7.25/30 and 7.37/45.

6.77%, 6.94%, 7.05% and 7.17% respectively during morning hours of trading against its previous day’s closing levels of 6.19/21, 6.25/30, 6.95/00, 7.12/17, 7.25/30 and 7.37/45.

However selling interest from these levels towards the latter part of the day saw yields increase once again with said maturities hitting highs of 6.20%, 6.30%, 6.95%, 7.10%, 7.25% and7.35% respectively. In addition, maturities of 01.03.21, 01.05.21, 15.10.21, 01.10.22, 15.07.23, 01.09.23, 15.12.23, 01.08.25 and 01.08.26 traded at levels of 5.55%, 5.70%, 5.90%, 6.02%, 6.39% to 6.40%, 6.40% to 6.55%, 6.45%, 7.10% and 7.14% to 7.15% respectively.

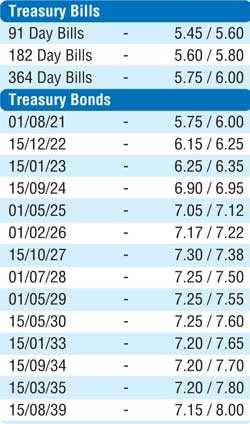

At today’s Treasury bill auction, a total amount of Rs.27 billion will be on offer, consisting of Rs. 7.5 billion on the 91 day, Rs. 3.5 billion on the 182 day and Rs. 16 billion on the 364 day maturities. At last week’s auction, the weighted average yields decreased across the board by 37, 48 and 30 basis points respectively to 6.30% each and 6.62%.

In secondary bills, August 2020 to October 2020 changed hands at 5.50%.

The total secondary market Treasury bond/bill transacted volume for 22 June was Rs. 20.60 billion.

In money markets, the DOD (Domestic Operations Department) of Central Bank refrained from conducting any auction despite the overnight net liquidity surplus in the system standing at a high of Rs. 204.74 billion yesterday. The weighted average rates on overnight call money and repo rates were recorded at 5.60% and 5.65% respectively.

Rupee appreciates marginally

In Forex markets, the USD/LKR on spot contracts was seen appreciating marginally yesterday to close the day at Rs. 186.55/65 against its previous day’s closing level of Rs. 186.60/70 on the back of selling interest by Banks.

The total USD/LKR traded volume for 22 June was $ 81.21 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)