Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 14 January 2019 00:24 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The bond market opened the week ending 11 January 2019 on a bearish mode but returned to a positive mode by the latter part of the week on the back of the primary auction outcomes.

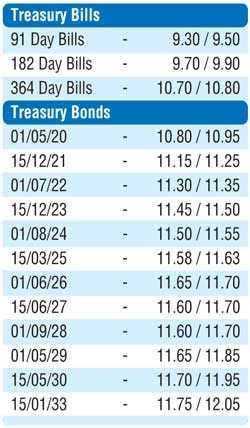

Firstly, the weighted average on the 364 day bill decreased by 14 basis points to 10.85% at the weekly Treasury bill auction. Secondly, The Treasury bond auctions conducted Friday recorded impressive outcomes as the weighted averages on the 4 year and 11 month maturity of 15.12.2023 and the 9 year and 8 month maturity of 01.09.2028 recorded 11.58% and 11.73% respectively with the exact offered total amount of Rs. 98 billion been fully accepted at the phase I stage. The bid to offer ratio stood at 2.44:1.

In the secondary bond market, the liquid maturities of 01.05.20, two 2021’s (i.e. 01.03.21 and 15.12.21), 15.12.23, 15.03.25, 01.06.26 and 01.09.28 were seen dipping to weekly lows of 10.85%, 11.15%, 11.20%, 11.44%, 11.60%, 11.67% and 11.60% respectively following the bond auction outcomes from its highs of 11.00%, 11.25%, 11.38%, 11.50%, 11.80%, 11.85% and 11.70% respectively. Activity picked up by the end of the week with considerable volumes commencing to change hands. In addition, the 364 day bill was seen changing hands at 10.79% and 10.80% as well in the secondary market.

In the secondary bond market, the liquid maturities of 01.05.20, two 2021’s (i.e. 01.03.21 and 15.12.21), 15.12.23, 15.03.25, 01.06.26 and 01.09.28 were seen dipping to weekly lows of 10.85%, 11.15%, 11.20%, 11.44%, 11.60%, 11.67% and 11.60% respectively following the bond auction outcomes from its highs of 11.00%, 11.25%, 11.38%, 11.50%, 11.80%, 11.85% and 11.70% respectively. Activity picked up by the end of the week with considerable volumes commencing to change hands. In addition, the 364 day bill was seen changing hands at 10.79% and 10.80% as well in the secondary market.

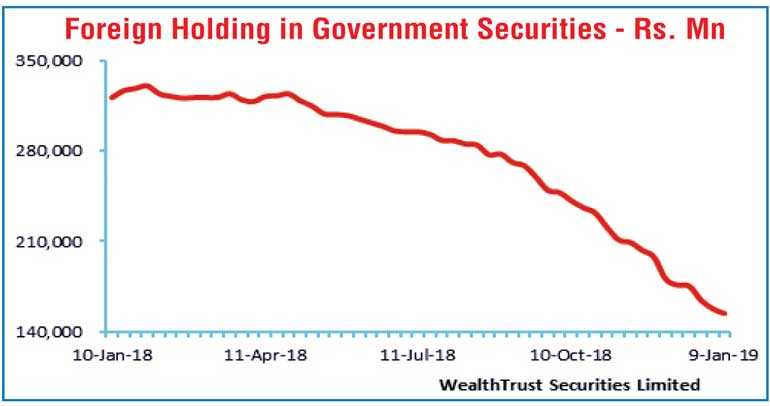

Nevertheless, the foreign holding in rupee bonds was seen decreasing further for a nineteenth consecutive week to record an outflow of Rs. 3.6 billion for the week ending 9 January. The daily secondary market Treasury bond/bill transacted volume for the first four days of the week averaged Rs. 9.95 billion.

In the money market, the overnight call money and repo rates averaged 9% during the week as the average net overnight liquidity shortfall in the system decreased to Rs. 84.96 billion for the week against its previous week of Rs. 113.20 billion. The OMO (Open Market Operation) Department of Central Bank continued to inject liquidity during the week on an overnight and term (i.e. six and seven days) basis at weighted averages ranging from 8.99% to 9.00%. Interestingly, the 11 October 2019 bill maturity (273 days) was purchased at a weighted average yield of 10.10% at an OMO auction for outright purchase of Treasury bills.

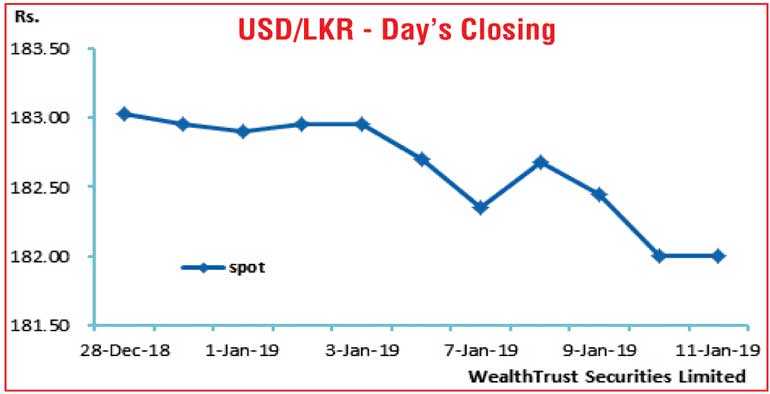

Rupee appreciates further

The USD/LKR rate on spot contracts appreciated further during the week to close the week at Rs. 181.90/10 against its previous weeks closing levels of Rs. 182.65/75 on the back of bank selling interest and export conversions following the agreement with the Reserve Bank of India to provide a $ 400 million SWAP facility to the Central Bank of Sri Lanka (CBSL).

The daily USD/LKR average traded volume for the first four days of the week stood at $ 82.14 million.

Some of the forward dollar rates that prevailed in the market were one month – 182.80/20; three months – 184.60/00 and six months – 187.55/95.