Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 25 January 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market closed the week ending 22 January 2021 on a bearish sentiment despite commencing and gliding through the week on a positive sentiment driven by the outcome of the weekly Treasury bill auction.

The secondary bond market closed the week ending 22 January 2021 on a bearish sentiment despite commencing and gliding through the week on a positive sentiment driven by the outcome of the weekly Treasury bill auction.

At the weekly bills auction, the weighted average rate on the benchmark 364-day bill dipped by three basis points to 4.99%, breaching the psychological 5.00% level for the first time in nine weeks while the total offered amount of Rs. 40 billion was successfully subscribed for a third consecutive week.

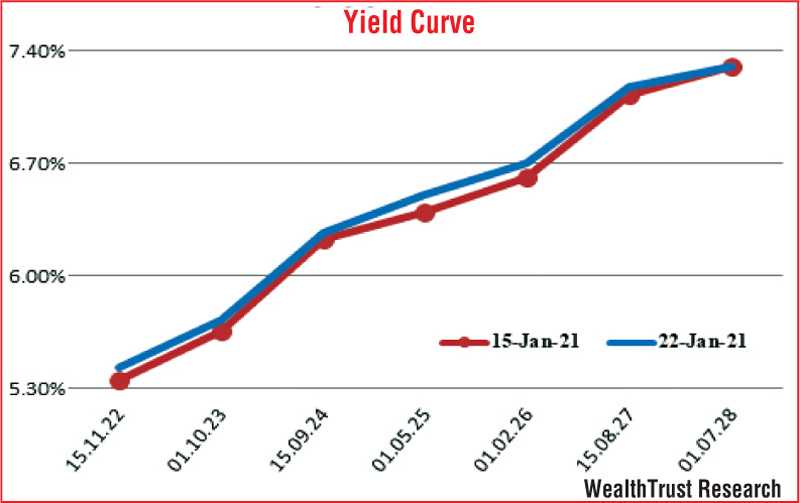

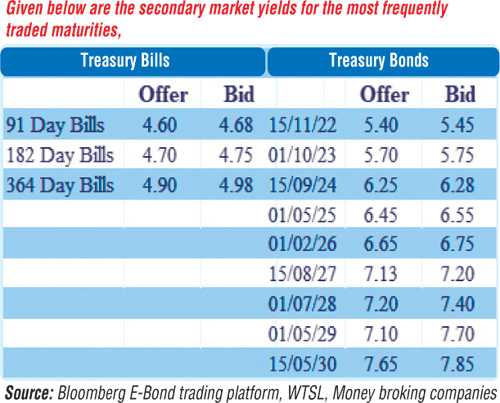

In the secondary bond market, yields on the liquid maturities of 2022’s (i.e. 15.11.22 and 15.12.22), 01.10.23 and 2024’s (i.e. 15.09.24 and 01.12.24) were seen dipping to weekly lows of 5.35%, 5.36%, 5.68%, 6.20% and 6.22% respectively following the weekly bill auction outcome from its highs of 5.42%, 5.44%, 5.74%, 6.28% and 6.35% respectively. However, selling interest at these levels on the back of a dip in money market liquidity coupled with the announcement of T-bonds auctions for 27 January resulted in yields increasing once again form its weekly lows towards the latter part of the week with activity slowing down considerably.

In addition, maturities of 01.10.22, 2023’s (i.e. 15.01.23, 15.07.23, 15.12.23), 15.06.24, 01.05.25 and 2026’s (i.e. 15.01.26 and 01.02.26) traded at levels of 5.35% to 5.45%, 5.40%, 5.65% to 5.67%, 5.60% to 5.78%, 6.20%, 6.44%, 6.60% and 6.65% respectively as well while April, June, August 2021 bill maturities as well as the 14th January 2022 bill were seen changing hands at 4.58% to 4.71%, 4.72%, 4.75% and 4.91% respectively in the secondary market.

The foreign holding in Rupee bonds remained mostly unchanged recording a meager inflow of Rs. 0.16 million for the week ending 20 January 2021.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 16.69 billion.

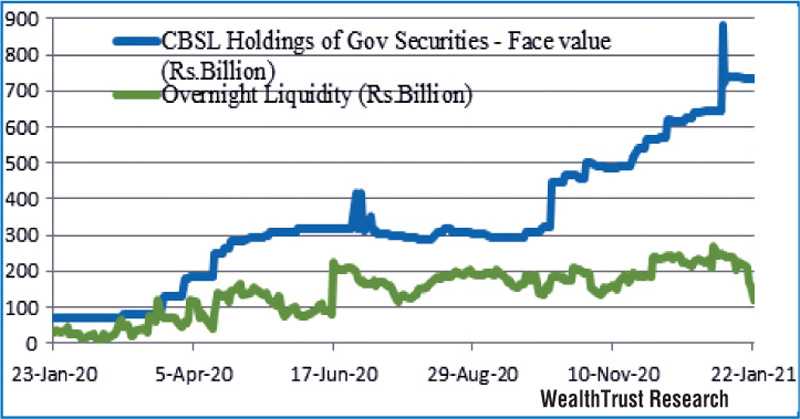

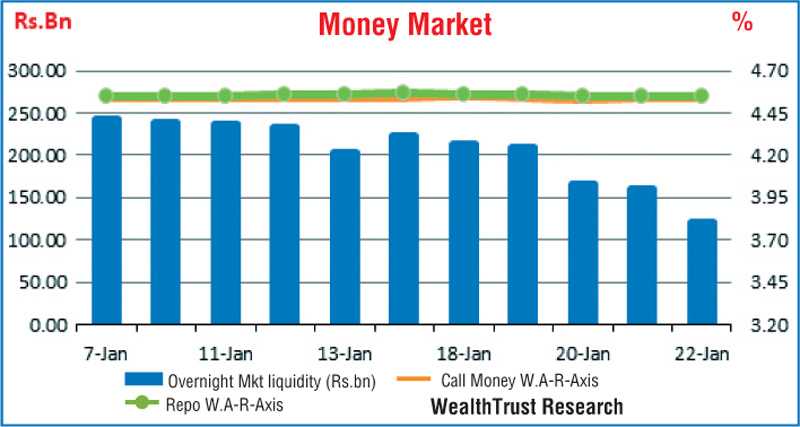

In money market, the total outstanding market liquidity was seen decreasing sharply over the week to close the week at Rs. 121.40 billion in comparison to its previous weeks closing of Rs. 222.45 billion. The weighted average rates on overnight call money and repo was steady to average 4.54% and 4.55% respectively for the week while CBSL’s holding of Gov. Security’s decreased marginally to Rs. 724.25.

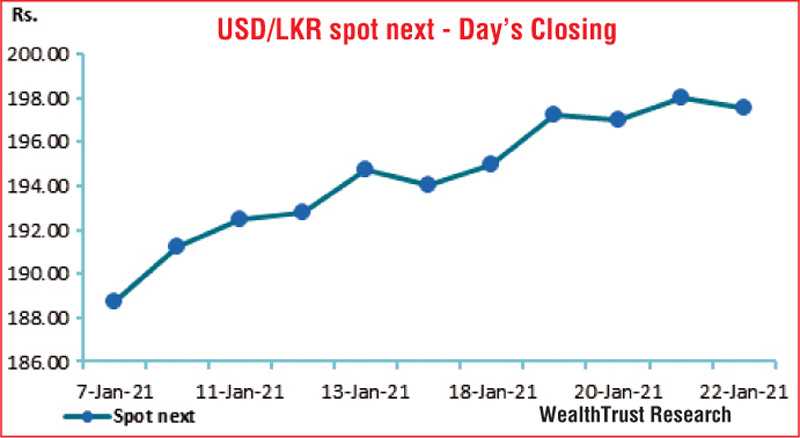

Rupee depreciates further

In the Forex market, the USD/LKR rate on spot next contracts was seen depreciating further during the week to close the week at Rs. 196.50/198.50 against its previous weeks closing level of Rs. 193.00/195.00 on the back of continued demand by banks. The more demanded spot contracts traded at level of Rs. 196.00 to Rs. 197.50.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 52.34 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies.)