Monday Mar 09, 2026

Monday Mar 09, 2026

Friday, 3 June 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

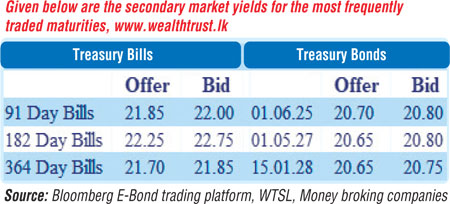

The bullish momentum in the secondary bond market continued yesterday as well, as yields across all three active maturities dipped below 21.00% for the first time since April 2022. The liquid maturities of 01.06.25, 01.05.27 and 15.01.28 saw its yields hit intraday lows of 20.80% each and 20.70% respectively against its previous day’s closing levels of 21.15/20, 20.50/00 and 21.00/20.

The bullish momentum in the secondary bond market continued yesterday as well, as yields across all three active maturities dipped below 21.00% for the first time since April 2022. The liquid maturities of 01.06.25, 01.05.27 and 15.01.28 saw its yields hit intraday lows of 20.80% each and 20.70% respectively against its previous day’s closing levels of 21.15/20, 20.50/00 and 21.00/20.

In addition, the 01.12.24 maturity traded at a level of 20.90% as well. Secondary bills remained active as well with the maturities of August and September 2022 along with 2 June 2023 changing hands at levels of 21.75% to 21.90% and 22.81% to 23.00% respectively.

The total secondary market Treasury bond/bill transacted volume for 1 June was Rs. 50.45 billion. In money markets, the weighted average rates on overnight Call money and REPO was registered at 14.50% each while the net liquidity deficit stood at Rs. 541.90 billion yesterday. An amount of Rs. 199.55 billion was deposited at Central Bank’s Standard Deposit Facility Rate (SDFR) of 13.50% while an amount of Rs. 741.44 billion was withdrawn from Central Bank’s Standard Lending Facility Rate (SLFR) of 14.50%.

Forex market

In the forex market, the middle rate for USD/LKR spot contracts depreciated further to Rs. 360.60 yesterday against its previous day’s Rs. 360.1114.

The total USD/LKR traded volume for 1 June was $ 21.97 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)