Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 18 December 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market was at a standstill yesterday, with market participants opting to be on the sidelines.

The secondary bond market was at a standstill yesterday, with market participants opting to be on the sidelines.

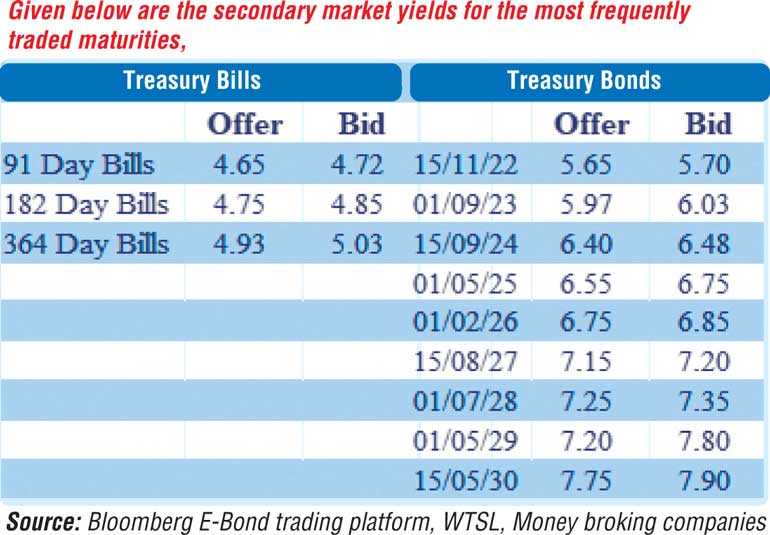

The short maturity of 01.08.21 witnessed some amount of trading at levels of 4.79% to 4.85%, while in the secondary bill market the March, June and July 2021 maturities changed hands at level of 4.65%, 4.76% and 4.75% respectively.

The total secondary market Treasury bond/bill transacted volumes for 16 December was Rs. 20.11 billion.

In money markets, the overnight surplus liquidity stood at Rs. 225.02 billion while the weighted average rate on overnight call money and repo’s was at 4.53% and 4.57% respectively.

Rupee appreciates

In the Forex market, the USD/LKR rate on spot next contracts appreciated further to close the day at Rs. 187.70/10 in comparison to its previous day’s closing levels of Rs. 188.20/70. Spot contracts remained unquoted.

The total USD/LKR traded volume for 16 December was $ 47.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)