Friday Feb 27, 2026

Friday Feb 27, 2026

Wednesday, 9 June 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

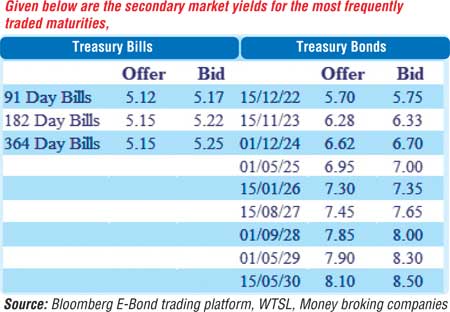

The activity in the secondary bond market was at a standstill yesterday while yields remained steady ahead of today’s Treasury bill auction. Limited trade was witnessed on the maturities of 15.12.22, 15.03.25 and 01.08.26, at levels of 5.75% to 5.90%, 6.96% and 7.45% respectively.

The activity in the secondary bond market was at a standstill yesterday while yields remained steady ahead of today’s Treasury bill auction. Limited trade was witnessed on the maturities of 15.12.22, 15.03.25 and 01.08.26, at levels of 5.75% to 5.90%, 6.96% and 7.45% respectively.

At today’s bill auction, Rs. 51 billion will be on offer, consisting of Rs. 10 billion on the 91-day, Rs. 23 billion on the 182-day and Rs. 18 billion on the 364-day maturities. At last week’s auction, the weighted average rate on the 91-day bill increased by 2 basis point to 5.13%, while weighted average rates on the 182-day and 364-day maturities increased by 3 basis points each to 5.17% and 5.21% respectively.

The stipulated cut off rate on the 364-day maturity remained steady at 5.21% while the maximum yield rates of the 91-day and 182-day maturities will be decided below the level of the 364-day maturity at the auction.

The total secondary market Treasury bond/bill transacted volume for 7 June was Rs. 3.25 billion.

The weighted average rates on overnight call money and repo remained mostly unchanged at 4.76% and 4.75% respectively as the overnight net surplus liquidity increased once again to Rs. 111.42 billion yesterday.

USD/LKR

In Forex markets, the USD/LKR rate on cash to one month forward contracts saw continued buying interest at Rs. 199.99 while overall market continued to remain inactive.

The total USD/LKR traded volume for 7 June was $ 32 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)