Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 18 April 2022 01:33 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

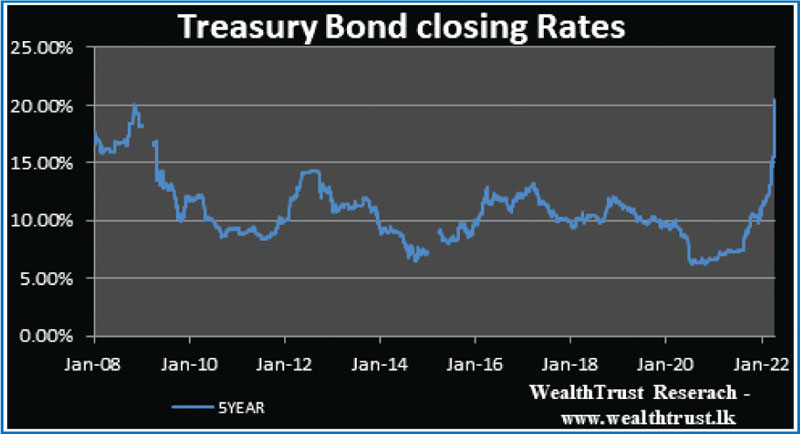

In a very shortened trading week ending 12 April where Treasury bill rates were seen increasing to highs seen in over 25 years, the secondary bond market was at a complete standstill as sentiment turned negative.

In a very shortened trading week ending 12 April where Treasury bill rates were seen increasing to highs seen in over 25 years, the secondary bond market was at a complete standstill as sentiment turned negative.

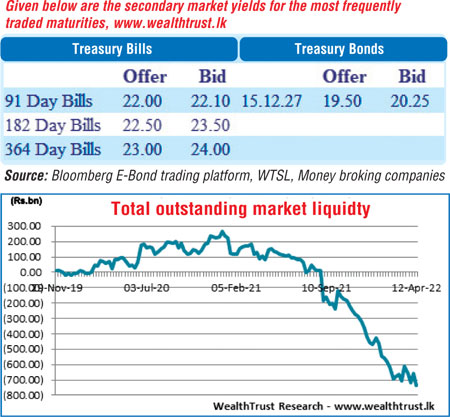

Nevertheless, activity was witnessed in the secondary bill market as the three month bill changed hands at levels of 21.50% to 22.00% and 1 year at 22.50% to 23.25%.

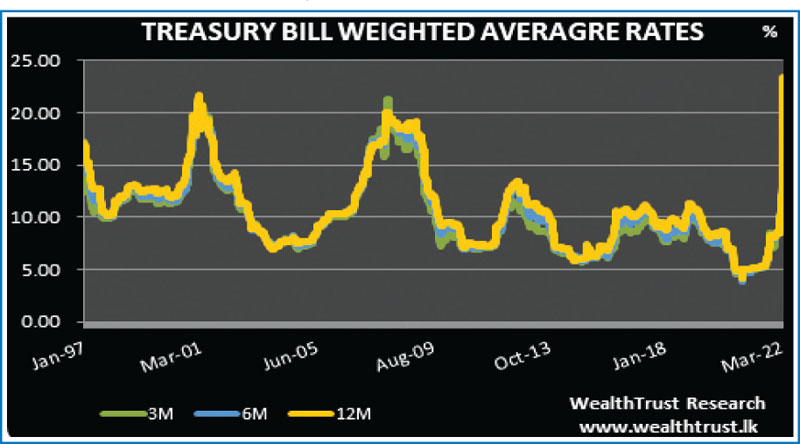

This was following the weekly bill auction conducted on Monday, the first after the steep monetary policy adjustment, where the subscription level increased to 93.71% of its total offered amount. Weighted average rates increased across the board by 559, 737 and 767 basis points on the three month, six month and one year maturities respectively to 19.71%, 22.73% and 23.36%.

The total secondary market Treasury bond/bill transacted volume for 11 April was Rs. 22.02 billion and the foreign holding in rupee bonds remained unchanged at Rs. 2.65 billion for the week ending 11 April.

In money markets, the base rate increase resulted in weighted average rates on overnight call money and repo increasing during the week to average 14.50% each, as against its previous weeks of 7.49% and 7.50% respectively. The total outstanding liquidity deficit increased during the week to register Rs. 735.46 billion by the end of the week against its previous weeks Rs. 660.47 billion while CBSL’s holding of Gov. Securities increased to Rs. 1,853.01 billion against its previous weeks Rs. 1,849.70 billion.

The Domestic Operations Department (DOD) of Central Bank was seen injecting liquidity by way of 14 day reverse repo auction at a weighted average rate of 17.00%.

Forex Market

In Forex markets, activity levels remained muted.

The total USD/LKR traded volume for 11 April was $ 15.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)