Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 11 March 2022 03:26 - - {{hitsCtrl.values.hits}}

By Courtesy Wealth Trust Securities Ltd.,

The secondary bond market was at a complete standstill yesterday ahead of a round of Primary auctions. The primary Treasury bond auctions due today will see a total volume of Rs. 120 billion on offer in lieu of Rs. 64 billion maturities which are due on 15 March.

The secondary bond market was at a complete standstill yesterday ahead of a round of Primary auctions. The primary Treasury bond auctions due today will see a total volume of Rs. 120 billion on offer in lieu of Rs. 64 billion maturities which are due on 15 March.

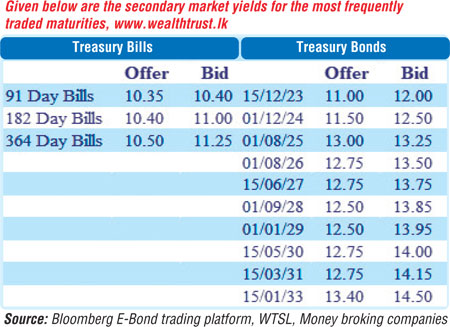

This will consist of Rs. 25 billion of a 01.08.2024 maturity, Rs. 35 billion of a 15.06.2027 maturity and further Rs. 60 billion of a 01.12.2031 maturity. At the auctions conducted on 25 February, an amount of Rs. 32.4 billion was taken up in total against a total offered amount of Rs. 45 billion while weighted average rates were recorded at 12.25% and 13.14% respectively on the 01.08.25 and 15.01.33 maturities.

The second phase of the auction was opened for the 15.01.33 maturity while a direct issuance window of 20% of the offered amount was opened on the 01.08.2025 maturity.

The total secondary market Treasury bond/bill transacted volume for 9 March was Rs. 50.65 billion.

In money markets, the overnight net liquidity deficit was registered at Rs. 613.63 billion yesterday, as an amount of Rs. 77.62 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 6.50% against an amount of Rs. 691.25 billion withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 7.50%. The weighted average rates on overnight Call money and REPO stood at 7.48% and 7.50% respectively.

In Forex markets, the USD/LKR rate on spot contracts was seen closing the day at Rs. 255/265 yesterday subsequent to trading within a range of Rs. 250 to Rs. 260.

The total USD/LKR traded volume for 9 March was $ 90.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)