Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 26 August 2020 00:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

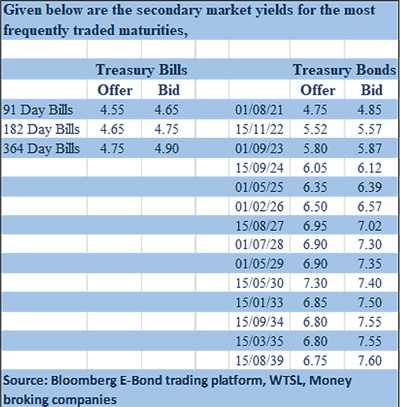

Activity in the secondary bond market picked up marginally yesterday, with maturities consisting of the 2022s (i.e. 15.11.22 & 15.12.22), 2023s (i.e. 15.01.23, 15.07.23 & 01.09.23), 2024s (i.e. 15.03.24, 15.06.24 & 15.09.24), 01.05.25, 01.02.26 and 15.05.30 changing hands at levels of 5.55%, 5.58% to 5.61%, 5.60%, 5.78% to 5.80%, 5.85%, 6.05%, 6.10% to 6.14%, 6.10%, 6.36% to 6.37%, 6.50% to 6.52% and 7.34% respectively. Furthermore, the shorter end maturity of 01.08.21 was traded at a level of 4.85%.

Today’s auction will have on offer a total amount of Rs. 40 billion, consisting of Rs. 5 billion of the 91 day, Rs. 15 billion of the 182 day and Rs. 20 billion of the 364 day maturities. At last week’s auction, the weighted average rates decreased across the board by 06, 05 and 03 basis points respectively to 4.59%, 4.71% and 4.90%, with the same rates been announced as the stipulated cut offs for today’s auction. In the secondary bill market, the 20 November 2020 maturity was seen changing hands at 4.70%.

The total secondary market Treasury bond/bill transacted volumes for 24 August was Rs. 6.72 billion.

In the money market, overnight surplus liquidity stood at a high of Rs. 191.09 billion yesterday, with the weighted average rates of overnight call money and Repo’s remaining steady at 4.53% and 4.54% respectively.

LKR loses further

In the Forex market, USD/LKR rate on spot contracts was seen depreciating sharply to hit intraday lows of Rs. 186.80 before closing the day at Rs. 186.30/70 against its previous day’s closing level of Rs. 184.90/10 on the back of continued buying interest.

The total USD/LKR traded volume for 24 August was $ 39.08 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)