Tuesday Jul 01, 2025

Tuesday Jul 01, 2025

Tuesday, 10 December 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market activity moderated considerably yesterday ahead of the weekly Treasury bills auction due today. Limited trades were witnessed on the 01.05.20, 01.01.24 and 15.03.25  maturities at yields of 7.85%, 9.95% to 10.03% and 10.10% respectively.

maturities at yields of 7.85%, 9.95% to 10.03% and 10.10% respectively.

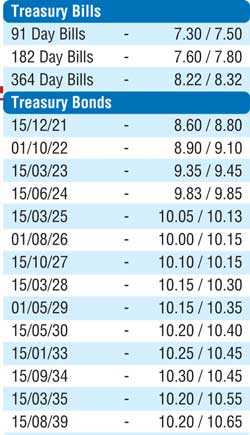

Today’s auction will have on offer a total amount of Rs. 27 billion, consisting of Rs. 1 billion of the 91 day, Rs. 12 billion of the 182 day and Rs. 14 billion of the 364 day maturities. At last week’s auction, the 364 day bill weighted average decreased by 07 basis points to 8.22% while the 182 day bill weighted average decreased by 07 basis points to 7.60%. The weighted average on the 91 day bill remained unchanged at 7.45%. The total secondary market Treasury bond transacted volume for 6 December was Rs. 8.45 billion.

In money markets, the overnight call money and repo rates averaged 7.53% and 7.55% respectively as the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka injected an amount of Rs. 12 billion on an overnight basis by way of a Reverse Repo auction at a weighted average of 7.53%. The net overnight liquidity surplus increased to Rs. 19.29 billion yesterday.

Rupee dips marginally

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating slightly yesterday to close the day at Rs. 181.20/30 against its previous day’s closing levels of Rs. 181.15/25 on the back of buying interest by banks.

The total USD/LKR traded volume for 6 December was $ 66.41 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 181.60/75; three months – 182.50/70; six months – 184.30/60.

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.