Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 22 March 2023 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The IMF’s Executive Board approval yesterday for an Extended Fund Facility to Sri Lanka saw activity increase in the secondary bond market ahead of today’s weekly Treasury bill auction.

The activity centered on the liquid maturities of 2027’s (i.e., 01.05.27 & 15.09.27) as its yields were seen dipping to intraday lows of 27.50% and 27.40% respectively during morning hours of trading against its previous day’s closing levels of 28.00/15.

However, additional supply side pressure resulting from the government allocation of bonds to institutes led to selling interest at these levels which in turn prevented yields declining further, while it rose to intraday highs of 28.00% and 28.25% respectively before closing lower at 27.90/00. In the secondary bill market, August-September 2023 and March 2024 maturities were seen trading at a low of 26.00% and 24.00% respectively.

This was ahead of today’s weekly Treasury bill auction, where a total amount of Rs.125 billion is on offer, an increase of Rs. 5 billion over its previous week. This will consist of Rs. 55 billion on the 91-day maturity and Rs. 30 billion on the 182-day maturity and a further Rs.40 billion on the 364-day maturity. At last week’s auction, the weighted average rate on the 91-day maturity decreased by 81 basis point to 27.94% while the weighted average rates on the 182-day and 364-day maturities decreased by 43 and 51 basis points respectively to 27.34% and 25.92%. A total amount of Rs. 150 billion was accepted against its total offered amount of Rs. 120 billion.

Meanwhile, the National Consumer Price Index -NCPI (Base;2021=100) or National inflation for the month of February came in at 53.6% on its point to point as against 53.2% recorded in January.

The total secondary market Treasury bond/bill transacted volume for 20 March 2023 was Rs. 6.06 billion. In money markets, the weighted average rates on overnight call money and REPO stood at 16.49% and 16.50% respectively while an amount of Rs. 164.99 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 16.50%.

Forex Market

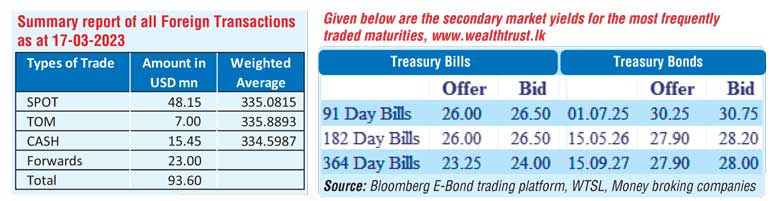

In the Forex market, the USD/LKR rate on spot contracts appreciated further to close the day at levels of Rs. 321.00/323.00 yesterday against its previous day’s closing of Rs. 332.00/335.00 subsequent to trading within the range of Rs. 333.00 to Rs. 320.00.

The total USD/LKR traded volume for 20 March was $ 93.60 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)